BTN research shows that 82 percent of buyers plan to

negotiate lodging rates for 2021. Sources see a hybrid approach shaping up,

where buyers are negotiating their top properties, but rolling over their 2020

rates for the majority, or switching to dynamic. Comments were edited for

length and clarity.

Look Who’s Talking...

Laura Kusto, Advito Sr. Director & BCD Travel Global Hotel Practice Lead

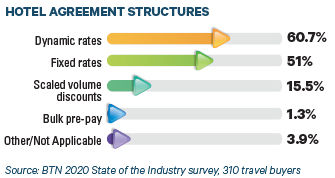

On Agreement Structures: The hybrid approach is the

thoughtful and right thing to do, given that many clients are either still not

on the road right now and may have a 50 percent to 70 percent drop in volume

for next year. You don’t want to ask hotels to take the time to bid on business

if you have no business.

On the Pandemic Opportunity to Reshape Hotel Sourcing: BCD

has been tracking rates for months and they are down. This environment gives

clients a safe way to try [dynamic pricing], to eliminate as much of the risk

as possible. I think that’s been a big positive.”

Look Who’s Talking...

Carmen Smith, ICF Sr. Manager Travel & Events

On Rolling Over Rates to 2021: I had just finished expanding

ICF’s hotel program in January. With Covid happening in March, I haven’t had a

chance to really look at productivity and what those hotels can or cannot do

for us. Currently, 16 hotels in the program are closed, but I’ve had challenges

getting in touch with hotels that are open. They’re not answering the phone, or

they take a long time. That said, I know one of our account managers just

returned from furlough and it’s great to have them back.

On the Prospect of Dynamic Pricing: Ninty-five percent of my

program is negotiated rates. I’m talking to some [hotel companies], and a few

chain brands wanted to move to dynamic, which I am not a fan of. For me,

dynamic seems to benefit the hotels more than the program.

On New Covid Health Standards: It is a partnership. We do

talk to suppliers, but we have to hold them accountable for the things they

promise. There have been some positive changes during Covid. Cleanliness

levels, for example, should stay in place. I’m hoping it holds all of us to a

higher standard going forward.

Look Who’s Talking...

Neil Hammond, GoldSpring Consulting Partner

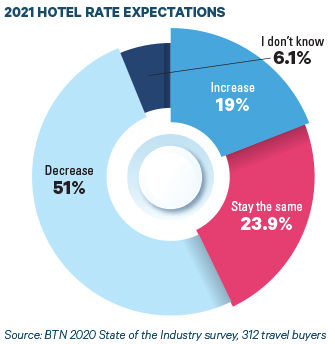

On 2021 Hotel Rates: Everybody understands that static rates

are not going to perform in the marketplace, not when the daily rates have gone

down 30 percent.

On the Prospect of Dynamic Float: One strategy will be to

roll rates over into 2021 but pair that rate with a dynamic float [i.e., the

company has the negotiated rate as a backstop, but the traveler will get the

dynamic rate if it’s lower]. Some chains are offering that float immediately,

but some are not starting it until Jan. 1 or even the program start [date] for

the corporation. That is something buyers should look out for. If you can, push

for the dynamic float to start now.

On Contract Terms: Some chains will be flexible with the

rollover and float, and willing to entertain properties being added to programs.

Others are saying, “You will sign this now and you will not negotiate for the

next 18 months.” So, if you make a change to the program, the agreement may be

off the table.

Look Who’s Talking...

Ann Dery, S&P Global Director of Global Travel

On S&P Global 2021 Hotel Strategy: Our program cycle is

June 1 to May 31. I extended rates through December when the pandemic hit.

[Going into 2021], it’s possible we’ll go with all dynamic rates. I don’t

really foresee a way I can negotiate in good faith any sort of static discount

when I have no idea what my volume will be. We will do an audit of all the

properties first to see if they are open, then we’ll see if negotiated rates

are anywhere near the best available rate.

On 2021 Negotiated Rates: I’ve looked at a study where the

average [negotiated] discount was 17 percent off BAR, which sounds about

right—somewhere between 10 percent and 20 percent, depending on the market. I

assume the companies that are going to get 30 percent [discounts] are the

Oracles, Googles and Microsofts of the world.

On Sustaining Supplier Relationships: It’s been challenging

and it’s different with different suppliers. We’ve had one hotel partner with

our account manager returning from furlough and actively engaging with us.

Others are still “MIA.” One company has asked me to go through a general email

address to request information. I was really surprised, and it’s a bit

alarming.

On Cleanliness Guarantees: The focus on cleanliness and

protocols is one of the positive things to come out of this. But how does a

hotel company guarantee those standards especially when so many are independent

franchisees? We’ve had an experience where travelers flagged a hotel that was

not living up to the enhanced standards. Our account manager handled the

situation immediately, comped the rooms and moved the travelers to new hotels.

That helped salvage the situation, but the [cleanliness] guarantee didn’t work.

Buyers will need to push for accountability in this area.

Look Who’s Talking...

Bjorn Hanson, NYU School of Professional Studies Jonathan M.

Tisch Center of Hospitality Adjunct Professor

On Taking the Negotiating Reins in 2021: My annual hotel

industry report predicts rate cuts of up to 25 percent. Some [buyers] are

saying they don’t know what to do and aren’t going to issue RFPs, but people

who have the best ability to negotiate right now are corporate travel managers.

On Onsite Service Levels & Responsiveness: Many hotels

are not fully staffed yet, and some front-of-the-house employees could be

supporting reduced housecleaning staff, for example. A general manager might

now be responsible for multiple hotels, so they might not be on the premises if

there’s an issue at another property, or the front desk person has a sign

saying “back in 10 minutes” because they are delivering towels to a room.

Look Who’s Talking...

Tobias Ragge, HRS Chief Executive Officer

On 2021 Hotel Rates: Nearly all HRS clients submitted RFPs

and their negotiations have produced reduced rates. When you look at the top 100

global destinations, then you see double-digit deductions, like in New York

City and San Francisco.

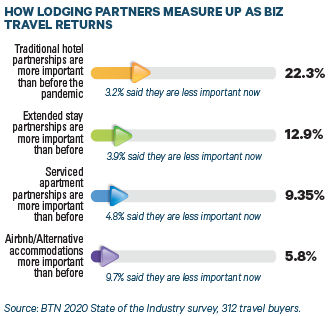

On Right-Sizing the Supplier Base: HRS is bundling

customers’ supplier portfolios. As the pandemic has reduced travel volume,

corporates need to reduce the number of participating hotels in a program to

make sure they still have buying power and something the hotel partner is

willing to commit to.

On Pockets of Pandemic Recovery: Occupancy in China is

already above 65 percent. They had the Golden Week [holiday] and domestic

leisure travel. We also see that domestic transient business travel is back to

normal. But China is an outlier. We do see the growing infection rates in

Europe and the U.S.

On the Pandemic Impact on Hospitality Technology: Technology

enhancements at hotels have accelerated, not just for cleaning, but also for

touchless experiences. Virtual payment is now a core topic to discuss. It’s a

smart integration into the hotel and creating a better experience for the

traveler—no invoices, no filling out expense templates.