It's been a little more than a month since American Airlines

began its New Distribution Capability push by removing some fares from

EDIFACT-connected channels. While still early in the game, light is shedding on

what that move really means.

The carrier on April 3 removed as much as 40 percent of its

fares from EDIFACT channels, making them available only in NDC-connected

channels.

"The first thing and most obvious is that American did

exactly as they said they would do, which doesn't always happen with airline

distribution strategies," distribution consultancy Garner CEO Cory Garner

said. Some thought that American might back off its strategy at the 11th hour,

but instead, the carrier stood its ground.

Initially, American said that the fares it would remove from

EDIFACT mostly would be basic economy fares, which often are blocked in

corporate travel programs because of their restrictions, limiting its effect on

managed travel. Instead, "the fares missing from EDIFACT are a lot more

than basic economy," said president of Travel Tech Consulting Norm Rose.

"It is a dramatic shift in the way that American wants

to distribute their product," Rose said. "It's an indication that we

are moving into an environment where the airlines will be selective of what

content they put into which channels. It's pretty dramatic in the industry. …

I'm not painting American as evil. It's a struggle for profitability

control."

Content Availability

As expected, there are variances between what is found in

EDIFACT and what is available in NDC pipes. Multiple sources noted they've also

seen price differentials between fares listed in global distribution systems

tapping NDC pipes and those available on AA.com. American denies this.

Even though American in its initial

December announcement said it would sometimes offer special limited-time

and AAdvantage member exclusive fares, the carrier said that it currently does

not have any AA.com-only offers available.

If there are differences between GDS NDC and direct-channel

pricing, a few sources said one possible reason could be caching—when multiple

copies of data are held in a temporary storage location so they can be accessed

faster.

"Everything in the American NDC API is available to all

GDSs to incorporate into their NDC connections," an American spokesperson

wrote to BTN in an email. "Each GDS builds their own connections to our

API, and they can choose which capabilities to incorporate."

Still, Rose noted the airline's setup means it no longer will

require full content sharing with GDSs.

"Because you have NDC at some level through the GDS

doesn't mean you will have total content," he said. "In addition, as

we move forward, the idea of the retail model is to really start bundling

dynamically, and when you have bundles to reflect customer needs and issues,

that destroys the process we've lived in for years, which is, ‘what is the

lowest logical airfare?’ The entire model is being blown up by this. Those

travel managers who think, 'I'll work by the sidelines, the GDS will solve

everything,' are fooling themselves. They will get complaints from travelers

about lack of parity and inventory sources."

This might already be happening.

For ITW director of global T&E Cathy Sharpe, there's

been a "slow trickle" of questions coming in from her travelers

around seeing fares on AA.com that are lower than those in the online booking

tool. There also are more differences between EDIFACT and NDC channels than she

anticipated. Sharpe noted that she has not yet turned on a GDS NDC channel for

her travelers and is using price tracking to note the differences.

"We are seeing main cabin differences, premium-class

differences," Sharpe said. "We haven't formulated any kind of

baseline of what would be my go-directly-to-the-airline versus not."

Sharpe noted she could use SAP Concur's TripLink to capture

data from direct American bookings, but "we are not sure to what level we

want to activate it yet." She also noted the possible use of non-GDS

aggregator TravelFusion to access AA content, but "we do value what the

agency does, and we want them to be part of our solution. We're not going to

pull the plug and say, 'Get the lowest fare.' It's about fare plus a whole lot

more."

Pricing Differentials

Another finding: "Fare differentials have come in a bit

broader than most people would have guessed," Garner said.

Travel management company AmTrav has been publicly tracking

the fare differences it is finding. On average, as of May 6, the company found

that 32 percent of the fares differed between non-NDC and NDC channels, though

that number was as high as 48 percent on April 10.

The price variance between average fares that showed

differences was $121, specifically $534 for non-NDC and $413 for NDC fares as

of May 6. When looking at overall average fares, including when there is not a

difference, the variance was much smaller: $477 for non-NDC versus $439 for NDC

fares, or $38.

AmTrav also is tracking fare differentials based on seat

type, and it has shown differences in economy, economy flexible, first class

and first flexible, as well as how often there is a difference (see charts).

The fares and discount percentages vary week-to-week, as do the frequencies of

discrepancies.

The discounts for the week of April 30 to May 6 for booking

an NDC fare versus an EDIFACT fare ranged from 13 percent for an economy ticket

to 31 percent for economy flexible and first flexible. Differences were found

35 percent of the time for economy tickets, 88 percent of the time for

first-class tickets, and 90 percent of the time for economy flexible ones.

"First class and economy flexible are three times

[higher] on [one seller's website], so this isn't just a basic economy problem.

It's affecting all corners of the market," AmTrav product marketing

director Elliott McNamee said. "If flying to an American hub, that's a

bigger deal than between cities that are not AA hubs. But it's affecting

everybody. The differences are real."

AmTrav president Jeff Klee concurred: "I want to

underscore the point that the notion that this isn't relevant to corporate

travelers and that only leisure fares are affected is complete BS," he

said. "If you look at the numbers, you'll find what American has done is

very relevant to corporate travelers."

The variances in the first-class buckets also were found to

be 35 percent to 40 percent lower on AA.com, according to a travel manager who

has Sabre conducting their tracking. The differences in coach weren't as much,

the travel manager said, but the variances for the first-class seats convinced

this buyer, who asked to remain anonymous, to turn on American's NDC

"because we have a select group of travelers flying first class," the

travel manager said. "The Sabre API will be turned on in two weeks.

Everything will be in our environment."

Differences in the Differentials

Other TMCs and industry suppliers tracking fare

differentials have found varying results. It appears that different markets

show different discrepancies. Fare differentials also depend on the makeup of

the TMC's customers, the size of the corporate travel air program, key markets

and travel policy.

"We're seeing fully refundable main cabin and

first-class domestic with some of the greatest price differentials," Fox

World Travel VP of business travel George Kalka said. "In fact, the

discounted first-class domestic is removed from EDIFACT and only on the NDC

channel. I look at that across our customer base."

Still, Kalka noted that the lower NDC fares are not ones his

corporate customers buy, such as basic economy class. The other fare differences

that he has seen are lower than AmTrav's numbers. He also noted that none of

his customers have opted to tap TravelFusion to access American's NDC fares because

of the sticking point that Ctrip, a Chinese-owned company, has a majority stake

in Travelfusion. "For any government contractor or entity, it's

non-negotiable," Kalka said.

"Within main cabin, our data is showing us that even

looking out 30 days from the date of travel, only 15 percent of the time there

is a fare difference of 5 percent or more favorable to NDC than EDIFACT,"

Kalka added. "Within seven days, it's down to single digits for the times NDC

has a better rate than what is offered in EDIFACT."

President of Tower Travel Management John Smith, whose

company is connected to American's NDC through Sabre, has noted that the number

of discrepancies between EDIFACT and NDC content appears to be growing, but the

dollar discrepancies have shrunk dramatically, he said. Over the course of the

first month, Smith reviewed 136 transactions, and in half of those cases there

wasn't even an NDC fare offered.

"For the balance where there was a difference, the

total net difference between [EDIFACT] and NDC was a 1.41 percent savings if

using NDC," he said, adding that sometimes he's even seen an EDIFACT fare

lower than an NDC fare. "Something at American's programming is not

perfect, which when you're rolling out a new technology across a universe of

transactions doesn't shock me at all."

Navan Group SVP of commercial Tom Rigby said that

month-to-date as of April 27, 50 percent of Navan's American bookings were

through the NDC channel, "due to the fact they are delivering more value

to the end user," he said. "On U.S. domestic flights, NDC bookings

are representing an average savings of 7 percent, and for international flights

it's quite a bit more, averaging around 27 percent."

Oracle director of global travel sourcing and GPO Rita

Visser, who has turned on NDC for both American and United Airlines and is

using Sabre and GetThere, has a solution that is seeing "nominal

savings" when NDC is being selected. "Only about 10 percent of the

time is an NDC fare better than an EDIFACT fare, right now," she said.

"And then the potential of what we're seeing from savings is well under 5

percent. We do see that percentage increase or savings increase when people are

going international."

Gant Travel Management president Patrick Linnihan said the

best summary he's seen is from Amadeus, in which there's more variance in

domestic flights, but not anything significant for international. He's also

found differences only in American-dominated markets. "Where American and

United are fighting it out, we did not find a difference," he said.

"In Charlotte, we found a difference."

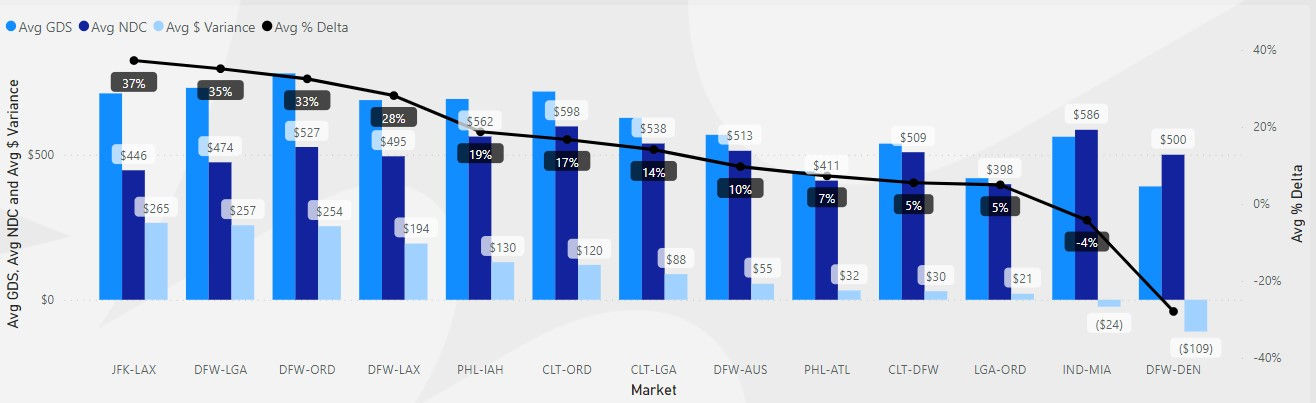

Relatedly, reshopping and analytics company Tripbam provided

an April 19-May 1 review of 13 of American's top U.S. city pairs that measured

the average GDS price versus the average NDC price for economy class when there

is a difference. It found the greatest price differential at $265 or 37 percent

off the EDIFACT fare for American's route between New York JFK and Los Angeles.

The next largest differential, the Dallas/Fort Worth and New York LaGuardia

route, showed an average NDC discount of $257 or 35 percent.

American Airline's NDC differentials by top routes, April 19-May 1. Click the expand button at the bottom right corner of the image to enlarge. Source: Tripbam

American Airline's NDC differentials by top routes, April 19-May 1. Click the expand button at the bottom right corner of the image to enlarge. Source: Tripbam

On the other end of the spectrum, the Indianapolis-Miami

route showed a lower EDIFACT fare by $24 or 4 percent, while the Dallas/Fort

Worth and Denver route had a $109 premium on the NDC fare for a 28 percent

difference.

"The average variance is that NDC fares are 25 percent

lower or the equivalent of $159 one-way," said Tripbam VP of air solutions

Jason Kramer. "That varies based on a lot of factors. It's not a

unilateral or uniform application to every single market. … [American is]

deploying their NDC approach differently in each market and having a different

impact in each market."

The greatest fare variance Tripbam has seen is among premium

full-fare tickets. "I would argue that is most likely because you have a

captive audience," Kramer said. "Those people buying last-minute [and]

are typically doing so through a TMC channel, and that TMC is not gaining

access to NDC content at American today."

Share Shift

Another trend TMCs have noticed: With rare exception, agents

have been able to find fares from Delta Air Lines, United and Southwest

Airlines that equal the American NDC fare in the GDS channel, Smith said.

"In either the agent desktop or the online booking

tool, our customers are getting the lowest fares in the market, including both

[EDIFACT] and NDC," Smith added. "Does that mean our share of tickets

sold on American during April declined? Absolutely. It is a zero-sum game. Our

shares on United, Delta and Southwest have all increased. Our customers are

following their company policy, which is to buy the more effective airfare per

their policy."

Kalka also has noted a share shift. For the first three

weeks of April, market share that Fox World Travel has transacted on American

had dropped 2.5 percent. "I find it interesting because we haven't done

anything to deemphasize American with what agents sell or search online,"

he said. "This is all customer-driven. Our share with American is the

lowest it's been in 12 months. Travelers are just not selecting American. That's

something we are watching."

Linnihan said Gant has turned on American NDC for all clients

and is offering them the option to opt out. So far, 12 travel managers have

made that request, adding that American's share of tickets for April dropped

three points from March. "It's one of two things: People either are

booking at AA.com, or they're booking away [from the carrier]," he said.

The anonymous travel manager added that they have

purposefully shifted share by biasing American in the company's booking tool

since March 1 in like-for-like markets in order to reduce the risk of not

knowing what would happen come April 3.

"We bias them as the lowest in our booking tool and

have seen shift away from them," the travel manager said. "[American]

won't appear in a market where there are connections or other nonstops; they

will appear at the bottom. That is how we've shifted 30 percent away since

March 1. If there was a competitor, we were able to switch it."

Sharpe said her company won't pull the plug on American.

"We are going to present all of the options, and our travelers will make

the best decisions for themselves and the company to benefit everybody across

the board," she said. "If a carrier is not competitive, they are

deselecting themselves."

_____________________________________

Read the second part of BTN's analysis of American's NDC move, which

looks at technical issues, other airlines' approaches to NDC, and cost

implications.