Most companies begin their GHG emissions reduction efforts

with a focus on Scope 1 and Scope 2, which are defined in order as 1) direct

emissions from owned or controlled sources and 2) indirect emissions from the

generation of purchased electricity, steam, heating and cooling consumed by the

reporting company, according to UK-based Carbon Trust. Scope 3 includes all

other indirect emissions that occur in a company’s value chain—including

business travel.

Companies with a large percentage of emissions tied to

business travel—like the consulting and professional services companies cited

above—might prioritize Scope 3 emissions reductions over other targets or run

that priority simultaneously. One reason is that Scope 1 and Scope 2 emissions

force businesses to look at their internal practices and not only the practices

of their supply chains when it comes to reduction.

International law firm Hogan Lovells committed to

science-based targets initiative in December 2020. Global travel manager David

McDonald, who is just beginning the firm’s journey toward sustainable business

travel, pointed out it was important to get your own house in order first

before reaching out to suppliers to contribute to the cause.

“We have started crafting a series of questions and requirements

that we would add into RFPs and/or contracts to wrap rigor around some of our

expectations,” he said. But in terms of concrete conversations with suppliers,

McDonald isn’t there yet. “The one thing I find very important—and all of us at

the firm agree—if we go to go out to our vendors and expect them to deliver

against responsible business goals, we should know what we are doing ourselves

and live in the same spirit of what we expect from suppliers. Will we be fully

mature? Doubtful. But we need to know how we will measure and manage.”

This attitude was quite different from one registered by a

leading U.S.-based buyer who spoke with BTN at an advisory meeting in mid-2019.

She indicated her sustainable business travel strategy would rely almost totally

on pushing suppliers to pass along their GHG emissions reduction bona fides and

to deliver more sustainable services. She characterized the process as a

“checkbox” exercise that would enable her CEO to create talking points for

investor meetings. Plenty of companies are still at that point, 11 percent

according to BTN’s survey (more than 20 percent who say they are tasked with

reducing travel don’t ask for any supplier information). That said, her company

at the time had no sustainability-focused leadership so any efforts towards

establishing sustainable travel practices were hers alone to manage—perhaps in

cooperation with her travel management company if that assistance could be

prioritized in the budget.

In canvassing several travel buyers for this issue, it

became clear that executive-level commitment to mitigating climate change was

the foundation for an effective sustainable business travel strategy.

Collaboration between business travel and a sustainability leader who would

help define strategy and contribute to decision-making around effective

projects to pursue provided travel program managers with the scaffolding

required to make dramatic changes to their programs. That said, nearly half of

travel buyers who participated in the BTN survey had not been formally tasked

with either assessing or mitigating carbon emissions associated with business

travel.

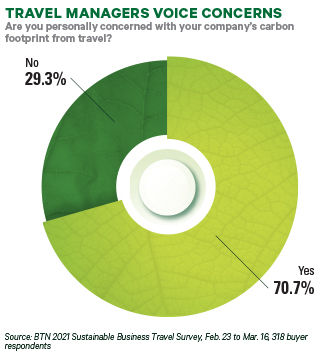

Still, 71 percent of buyers said they were personally

concerned about their company’s carbon footprint from travel. Several buyers in

this category said they were doing what they could to mitigate that

footprint—even without leadership support.

Demand management will be a key pillar for travel programs

moving forward, as confirmed by several surveys BTN has conducted over the past

year, and the recent sustainability survey was no exception. Nearly

three-quarters of buyers said they would shift some portion of business travel

to virtual meetings—with or without a mandate to reduce carbon footprint.

Others working solo on carbon reduction had more specific carbon mitigation

efforts on the books. A procurement manager at a U.S.-based international law

firm, who previously worked at an alternative fuel company, created a rail

program for travel within the Northeast Corridor to divert travelers from emissions-intensive

short-haul flights “and frankly give them more convenient options,” he said.

These types of one-off projects count toward total emissions reductions, so

when opportunities arise, travel buyers shouldn’t be afraid to take them, even

if they aren’t formally credited as a sustainability move.

Sometimes, however, it pays to think bigger, even without a

direct mandate to do so. FLSmidth global travel manager Merete Minnet is taking

this approach. While the Denmark-based multinational engineering company has

signed on to science-based targets to reduce GHG emissions, business travel

isn’t anywhere on the radar for those efforts.

“Ninety-six percent of our emissions come from our

customers,” she said of the company’s work providing solutions to cement and

mining plants, which are particularly emissions intense industries. “So getting

to zero emissions will come from providing better solutions to customers and

Scope 3 becomes a much lower priority. But I’m still working on it and looking

into it.”

The reason, she said, is because she wants to be prepared.

Given that her company has pledged emissions reductions, she believes

leadership will come knocking eventually for her to contribute to the cause.

“One day they will come to me and say, ‘We need zero emissions when we fly.’ I

need to be able to say, ‘Yeah, we can do that if we do this, this and this. And

it will cost this. So how do you want to do it?’”

Minnet already has had a handful of travelers come to her to

ask about offsetting carbon emissions for flights or about the ability to take

a direct flight instead of a connecting one to save on emissions. And though

the company still isn’t traveling much because of Covid-19 risks, she’s aware

her current key performance indicators are not aligned to support sustainable

travel options.

“The direct flight from Copenhagen to New York is 15,000

kroner. But with the stopover in Germany or the UK, it’s only 5,000 kroner. If

the travel program is only measured on savings, then I won’t be able to meet

those targets.”

Carbon consumption is featured in the company’s Egencia

booking tool, so she knows she will need to respond to inquiries from travelers

when the company begins traveling again in earnest. She and her Egencia account

managers are modeling different scenarios to understand different

options—including the option to disable that feature until FLSmidth is ready.

“We’re looking at our top city pairs out of Denmark and

other countries and looking at the difference in both price and carbon

emissions on direct flights and the stopover options. Currently, our policy is

to take the stopover if it’s less than a four-hour difference. I want to know

the cost and the emissions savings to understand what would happen if we

changed that policy. Then, I could send that model to management. Nothing is

free.”

She’s also looking at hotel partners to understand if any of

them have sustainability initiatives. She said it’s not likely because FLSmidth

locations tend to be outside of city centers and their top hotels aren’t always

the big brands. “Those are the hotels that will have sustainable options first,

but those aren’t generally the ones available in our locations. Do I put

travelers in a hotel farther away because it’s sustainable and then make them

drive or take Uber, adding a commute? Does it have to be Uber Green?” she

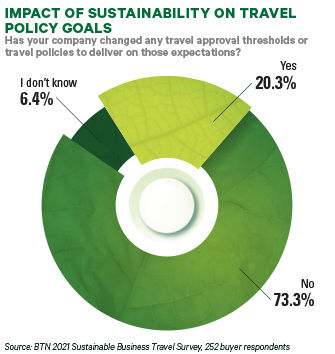

asked. The calculus gets complicated. This may be one reason sustainable travel strategy hasn't filtered through the majority of travel programs into hard-and-fast policy changes.

She has also considered what happens if she takes certain

options out of the booking tool entirely—non-sustainable hotels or flights that

are less sustainable than the same route on another airline. “Right now, I have

nearly 100 percent compliance on flights in my booking tool. I don’t want to

make changes that would sacrifice that,” she said. Her TMC partner is working

with her to understand these implications and create sustainability scenarios

that are, well, sustainable.

SECTION 5: More TMCs Getting on Board

Nearly seventy percent of the respondents to BTN’s survey

relied on their travel management companies and booking tool partners to

provide the data and decision-making support required to plan for sustainable

travel. continue...

SECTION 6: Changing the World

Rather than putting a hard stop on travel, corporate

partnerships and travel managers should prepare to play a huge role in changing

the travel industry, because demand for sustainable solutions will catalyze

innovation. finish

this article