Business Travel News’ 2023 Travel Manager Salary & Job Satisfaction Report

UNITED STATES

Salaries were on the rise again in 2023 for U.S.-based travel managers—and not just by a small margin. After a nearly 11 percent increase in salary level from 2021 to 2022, total annual compensation as reported by 328 vetted travel management professionals across the U.S. rose by another 10 percent to $141,075 from 2022 to 2023. That’s significantly ahead of inflation, which has hovered around 3 percent for the back half of the year.

It may be a sign that organizations are recognizing the complexity—and perhaps the strategic value—of travel management as more leaders have paid attention to the category since the pandemic.

Among this year’s U.S. respondents, a whopping 85 percent reported a salary increase over their 2022 compensation. Ten percent said they made the same in 2023 as they did the year before, and only 5 percent reported their salaries were down.

Even with salaries higher than ever, 38 percent of travel managers did not feel well compensated for the work they do. That compared with 48 percent who felt there was an equitable exchange of work to pay and 14 percent who said they were well paid for their responsibilities.

Travel Management Snapshot: Complexity Everywhere You Look

Asked what had changed in their jobs over the past 12 months, one buyer quipped, “I think the better question is what hasn’t changed!” Still, overall trends emerged.

Rising Costs – Open comments from BTN’s Salary & Job Satisfaction survey indicated another year of leadership scrutiny on business travel, with rising costs of travel driving a good piece of that interest. “Management is requesting more reports,” wrote one buyer. “Rising costs of travel are contrary to the requirement to cut costs,” wrote another.

Sustainability Efforts – Business travel sustainability was another leadership objective in 2023, often running counter to cost control, according to buyers. “Sustainability has become a much bigger issue,” wrote one buyer, among the many who mentioned such efforts. “We know we want to access more sustainable travel options, understand how they are measured and perhaps need to find alternative sources for that content,” a veteran buyer told BTN. “But we also need to realize that, at least right now, that often comes with a cost increase, and will our travel policies allow travelers to choose those options? Because right now those two motivations are in conflict.”

Disruption Management – Travel buyers cited increased complexity beyond cost and sustainability, like managing travelers who “forgot how to travel” amid higher disruption levels experienced by travel industry players than prior to the pandemic. The perception of the situation among some travel managers is dire, to the extent that it has hampered the return of business travel.

“Travel has become a crapshoot with frequent delays, terrible meltdowns, lack of hotel service and high hotel costs,” one wrote. “Our travelers just don't wish to travel now unless absolutely necessary. That is resulting in fewer business meetings and less travel overall.”

Diminished Focus on Managed Corporate Business – Survey commentary clearly showed a perception among travel buyers that supplier partners are putting less emphasis on the corporate market and are reticent to negotiate discounts and/or value-added benefits for corporate clients.

“Airlines, hotels, car rental [companies], etc. have so little focus on corporate buyers that it is a struggle just to maintain [the program] we have, much less move improvements forward,” wrote one buyer. Another said their suppliers were “looking for a new traveler” in the unmanaged business or leisure categories who have shown a new willingness to engage with premium products and services that once were the purview of frequent business travelers in larger corporate programs.

Content Fragmentation – Combine that with an environment in which airlines are fragmenting access to fare content via aggressive New Distribution Capability strategies and add some lingering service issues with agency partners—exacerbated by NDC—and the complexities get very clear, very fast.

BTN’s survey results delivered insights into how travel managers are dealing with these rising complexities and how they plan to continue those efforts in the coming months.

First, however, let’s take a deeper dive into salary levels.

Travel Management Snapshot: Complexity Everywhere You Look

Asked what had changed in their jobs over the past 12 months, one buyer quipped, “I think the better question is what hasn’t changed!” Still, overall trends emerged.

Rising Costs – Open comments from BTN’s Salary & Job Satisfaction survey indicated another year of leadership scrutiny on business travel, with rising costs of travel driving a good piece of that interest. “Management is requesting more reports,” wrote one buyer. “Rising costs of travel are contrary to the requirement to cut costs,” wrote another.

Sustainability Efforts – Business travel sustainability was another leadership objective in 2023, often running counter to cost control, according to buyers. “Sustainability has become a much bigger issue,” wrote one buyer, among the many who mentioned such efforts. “We know we want to access more sustainable travel options, understand how they are measured and perhaps need to find alternative sources for that content,” said veteran travel buyer Carol Schrager. “But we also need to realize that, at least right now, that often comes with a cost increase, and will our travel policies allow travelers to choose those options? Because right now those two motivations are in conflict.”

Disruption Management – Travel buyers cited increased complexity beyond cost and sustainability, like managing travelers who “forgot how to travel” amid higher disruption levels among experienced by travel industry players than prior to the pandemic. The perception of the situation among some travel managers is dire, to the extent that it has hampered the return of business travel.

“Travel has become a crapshoot with frequent delays, terrible meltdowns, lack of hotel service and high hotel costs,” one wrote. “Our travelers just don't wish to travel now unless absolutely necessary. That is resulting in fewer business meetings and less travel overall.”

Diminished Focus on Managed Corporate Business – Survey commentary clearly showed a perception among travel buyers that supplier partners are putting less emphasis on the corporate market and are reticent to negotiate discounts and/or value-added benefits for corporate clients.

“Airlines, hotels, car rental [companies], etc. have so little focus on corporate buyers that it is a struggle just to maintain [the program] we have, much less move improvements forward,” wrote one buyer. Another said their suppliers were “looking for a new traveler” in the unmanaged business or leisure categories who now are willing to engage with the premium products and services that once largely were the purview of frequent business travelers in larger corporate programs.

Content Fragmentation – Combine that with an environment in which airlines are fragmenting access to fare content via aggressive New Distribution Capability strategies and add some lingering service issues with agency partners—exacerbated by NDC—and the complexities get very clear, very fast.

BTN’s survey results delivered insights into how travel managers are dealing with these rising complexities and how they plan to in the coming months.

First, however, let’s take a deeper dive into salary levels.

A Regional Look

As in some previous years, the Rocky Mountain region delivered the lowest average travel management salary level in the in the U.S. at just under $114,000. That was followed by several regions that showed salaries in the low- to mid-$120,000 range. The Southeast, including cities like Atlanta and Charlotte, averaged $120,406. The Great Lakes, including Chicago, landed at $125,615; the Plains came through with $126,718 and the Northeast, including high-priced Boston, averaged $127,589.

Average salaries jumped above $150,000 in all other U.S. regions. The Southwest, which included major metropolitan areas in Texas and Arizona, delivered an average salary of $150,466; while the Mid-Atlantic, which includes metropolitan areas like Baltimore, D.C., and Manhattan jumped to $157,436. The highest-paid travel managers, according to BTN data, hailed from the West Coast. In the Northwest, including Seattle and Portland, travel managers brought in $163,859 on average annually. And in the West, including San Francisco and Los Angeles, average travel manager salaries hit $167,018.

Experience vs. Size of Program

There was clear overlap in the BTN survey regarding a travel manager’s years of experience and the size of the travel program they managed. It wasn’t always the case, however, that the most experienced individuals administered the largest programs—and it was the size of the program that largely determined the highest salaries among responding travel managers.

Still as one might expect, there was a clear correlation between the experience logged in travel management functions and the salary expectation. Travel managers with less than a year of experience averaged the lowest salaries at $84,333. It took 21 years of experience to achieve and/or beat the so-called “average” travel manager salary when looking across all respondents. That’s a long time, and it indicates that many travel managers responding to the survey have been in their careers for an extended period. There are other factors that could limit salary expectations or, indeed, surpass the average in a shorter time period. Per the geographic breakdown, location is one factor that could determine an upper and lower salary band.

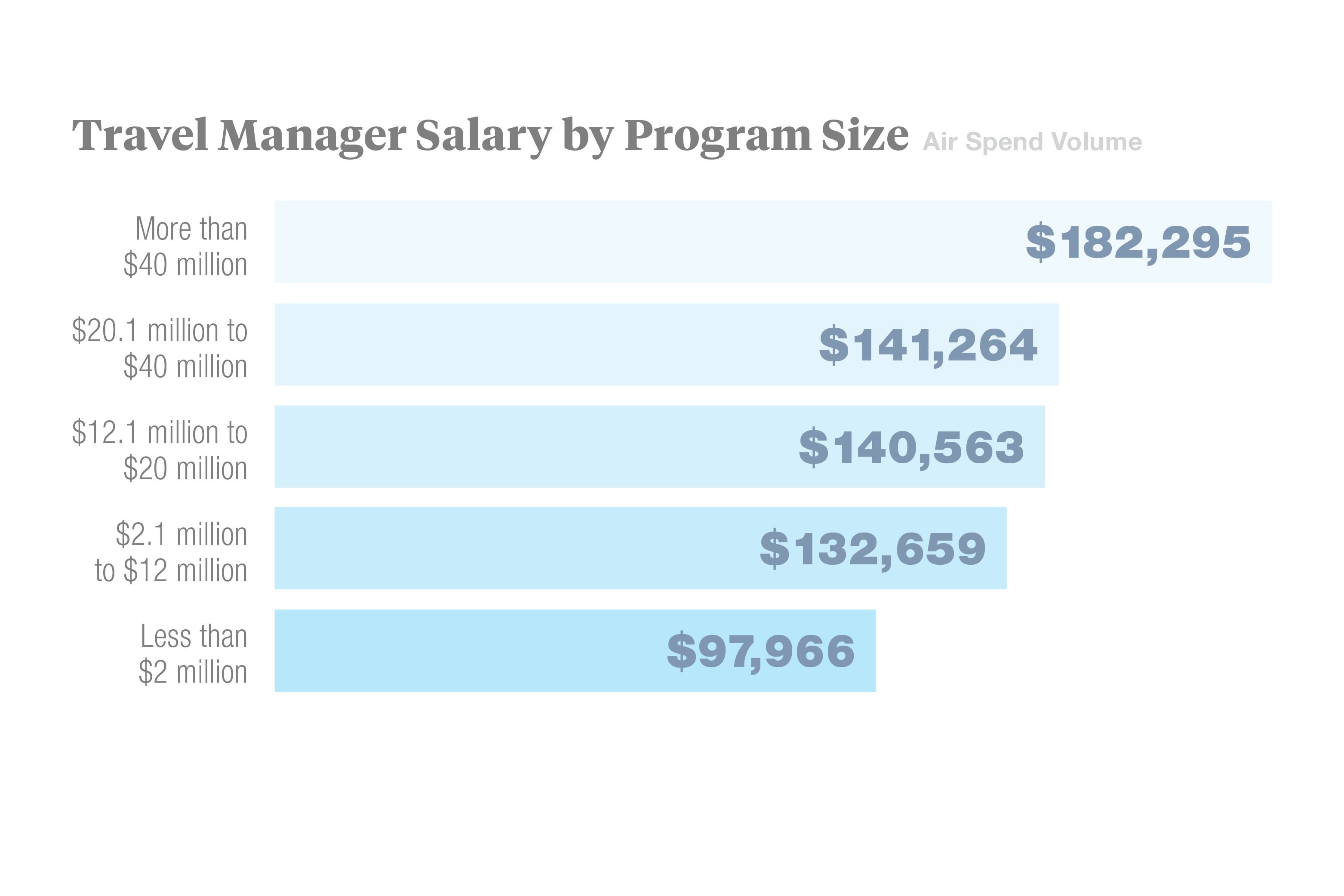

Looking at program spending levels, travel managers with the largest programs made significantly more than the next tier down. Those with travel program air spend exceeding $40 million raked in more than $40,000 more per year than those in the next tier down. The good news is that a travel program only needed to reach $12 million in air spend to put the average earner within striking distance of that healthy average salary.

Experience vs. Size of Program

There was clear overlap in the BTN survey regarding a travel manager’s years of experience and the size of the travel program they managed. It wasn’t always the case, however, that the most experienced individuals administered the largest programs—and it was the size of the program that largely determined the highest salaries among responding travel managers.

Still as one might expect, there was a clear correlation between the experience logged in travel management functions and the salary expectation. Travel managers with less than a year of experience averaged the lowest salaries at $84,333. It took 21 years of experience to achieve and/or beat the so-called “average” travel manager salary when looking across all respondents. That’s a long time, and it indicates that many travel managers responding to the survey have been in their careers for an extended period. There are other factors that could limit salary expectations or, indeed, surpass the average in a shorter time period. Per the geographic breakdown, location is one factor that could determine an upper and lower salary band.

Looking at program spending levels, travel managers with the largest programs made significantly more than the next tier down. Those with travel program air spend exceeding $40 million raked in more than $40,000 more per year than those in the next tier down. The good news is that a travel program only needed to reach $12 million in air spend to put the average earner within striking distance of that healthy average salary.

Gender Disparities

Pay disparities—in part the result of the more junior or lower profile roles being largely filled by women—continue to dog travel management as a profession. Seventy-four percent of BTN’s survey respondents were women, with the average salary among that group sitting at $136,737, which is 3 percent below the overall respondent average and 11 percent below the average $152,686 salary reported by male travel management colleagues.

With the size of the travel program a major salary driver, it’s worth calling out there was a stronger percentage of males managing the largest travel programs than the overall survey participation. For travel programs with more than $40 million in spend, 36 percent were managed by males, compared to the 26 percent share of males who took the survey.

Women managed 58 percent of those high-spending programs, but that compares to the survey universe that was 74 percent female. Looked at another way, 28 percent of all men who responded to BTN’s Salary Survey managed travel programs of more than $40 million in annual air volume. That number dropped to 15 percent for female respondents, indicating some barriers to advancement still exist for women, despite their dominance in terms of participation numbers in the travel management field.

That said, the situation looks to be improving—at least in the United States. For every dollar a man earned managing travel in 2023, a woman made 89 cents. That was up from 84 cents to the dollar in 2022 and up from 81 cents to the dollar in 2019, prior to the pandemic.

Current Demands & Dissonance

BTN’s Salary & Job Satisfaction survey asked travel managers about their current responsibilities and changing priorities within their programs. Respondents checked many of the most traditional boxes. Broadly speaking, 94 percent of travel managers select or recommend business travel suppliers, 86 percent select or recommend travel management technologies, 84 percent set policy, 82 percent negotiate with suppliers for transient rates, 81 percent manage cost controls and 74 percent are responsible for measuring or enhancing the traveler experience. None of that is surprising.

Asked how their focus had changed in the past year, however, respondents painted a more nuanced picture that showed how the travel management role has taken on new challenges and shown more strategic potential within the organization.

Time for More Tech

In the face of challenges like content fragmentation from NDC and exciting opportunities like artificial intelligence-powered services, well more than half of U.S.-based travel managers are spending more time and energy on program innovation and working out what new technologies and service models will allow them to manage their programs more effectively and efficiently.

A number of buyers commented on “travel becoming a more tech-driven process,” and that they spent “more time focused on technology approvals and supplier vetting.” For many, the fast-changing environment posed a challenge—“technology, ChatGPT, NDC challenges … lots of time spent figuring out how to manage these changes in a constantly moving environment,” wrote one buyer.

Technology advancements were a welcome change for some. One buyer cited the challenge as a key element in elevating their role in the organization: “I got the promotion I was looking for, or I would have left. Now, I’m concentrating more on strategy and data, more on technology investigation,” they wrote.

Into the Data Dimension

Forty-seven percent of travel buyers are spending more time and energy providing business travel intelligence to the organization, whether in terms of policy, costs or to identify opportunities.

“Much more attention is paid to policy compliance and reporting for leadership,” wrote one buyer. Said another: “The company has much more interest in travel spend, so we spend more time reporting out to stakeholders.”

Some companies have added resources to dedicate to travel data and intelligence initiatives. “Onboarding two very experienced travel specialists has allowed our travel team to be the strongest it's ever been,” wrote one buyer, who leads a midsize travel program and noted their organization was more focused on travel intelligence than ever. “They are diving into reports, analyzing data and discovering innovative ways to ensure the most efficient use of our travel spend.”

Syncing Up Sustainability

While the sustainability movement in the region is not as aggressive as seen in the European market, travel buyers in the U.S. presented a picture of growing awareness around the issue but in some cases a lack of clearly defined direction.

Forty-two percent of survey respondents said sustainability had become a more intensive focus of their remit, taking time and energy away from more traditional tasks. “We have less focus on pure travel management,” one buyer wrote, “and more in terms of savings, technology and sustainability.” Yet, hold the thought on that combination of changing priorities, because it’s not as straightforward as it may seem.

Buyers told BTN they were largely focused on gathering data to establish “baseline reporting” for future emissions comparisons, but also said they were trying to get a handle on more tactical aspects of sustainability—familiarizing themselves with the types of vendors and partners that could help them put some initial carbon reduction efforts in place. One buyer said they had initiated a carbon budget strategy for the travel program.

Whether about technology improvements, more data tools and analysis or sustainability efforts—or, indeed, any of the other new demands on travel managers’ time—it was the rare survey respondent who mentioned any commensurate investment or performance metrics created against these efforts.

One buyer, speaking to BTN on condition of anonymity, highlighted that as a problem.

“There is so much to do that travel managers have not had to contend with before,” they said. “But what’s not changing are the resources we can access to get the job done. I am one person managing this program, and while I may be getting paid more than I have been in the past, I’m working harder and longer hours, with more critical objectives than ever, and something has to give.”

Additionally, when there are strategic issues on the table like sustainability or even digitization, if travel buyer performance continues to be awarded against traditional metrics—like cost savings and avoidance—the buyer cannot successfully serve dissonant objectives.

“Take sustainability as an example,” one buyer said. “Our company may want to reduce carbon by using more electric vehicles for business travel. Electric vehicles are significantly more expensive to rent, so are they allowed by our policy? Right now, they wouldn’t be. By the same token, if I am rewarded mainly for driving cost savings or avoidance, how will I meet my performance objectives if I focus on driving sustainable—but more costly—travel?”

Job Performance & Satisfaction

Cost savings and avoidance is the most common metric against which travel buyers in BTN’s U.S. survey are currently measured (62 percent). That was followed closely, however, by delivering a strategic contribution to the organization (60 percent). Only one-third are specifically measured against program innovation and one quarter are considered for new technology implementations.

With the challenges presented by the market, the latter initiatives are where many buyers need to spend more of their time. Yet few will be willing to sacrifice attention to the former, given that their job performance metrics hinge on them. The result—seen among many comments in BTN’s survey—is a travel management professional who is shouldering “an unusually high workload” or “doing the work of two-plus people,” which may account for the 38 percent of survey respondents who consider themselves underpaid, despite the fact that—on average—U.S. travel manager salaries have never been higher.

Job Performance & Satisfaction

Cost savings and avoidance is the most common metric against which travel buyers in BTN’s U.S. survey are currently measured (62 percent). That was followed closely, however, by delivering a strategic contribution to the organization (60 percent). Only one-third are specifically measured against program innovation and one quarter are considered for new technology implementations.

With the challenges presented by the market, the latter initiatives are where many buyers need to spend more of their time. Yet few will be willing to sacrifice attention to the former, given that their job performance metrics hinge on them. The result—seen among many comments in BTN’s survey—is a travel management professional who is shouldering “an unusually high workload” or “doing the work of two-plus people,” which may account for the 38 percent of survey respondents who consider themselves underpaid, despite the fact that—on average—U.S. travel manager salaries have never been higher.

This 2023 BTN Group Report is published and distributed as part of BTN’s inaugural travel manager appreciation week celebration. BTN Group editorial director Elizabeth West, BTN Europe chief editor Andy Hoskins and BTN Group managing editor Chris Davis contributed to this report.