Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Global terror events, natural disasters and medical crises

have grabbed headlines more frequently over the past few years, making travel

risk management and traveler security a greater part of the travel management

conversation. But just where does the industry stand? How far does it still

have to go? And how do factors like a program's size and its frequency of

international travel change how organizations address safety and security?

In a BTN survey of 229 travel buyers and managers and

corporate safety and security managers, 65 percent said their companies'

attention to traveler safety and travel risk management has increased over the

past three years. The larger the company's travel spend, the more sharply it

has honed its attention to travel risk management. Only 52 percent of programs

that spend less than $10 million a year on travel increased their travel risk

management focus, but of those that spend $50 million or more on travel, 81

percent did so.

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

CTI senior travel coordinator Lisa Kaffenberger, whose

company spends less than $10 million a year on travel, said that disparity is a

resource issue, not a reflection of lower risk for smaller programs. Prior to

joining CTI, she worked for a company that "pinched pennies until they

squealed" and avoided any kind of spend on risk management, even after a

terror event occurred within blocks of some of the company's travelers. "In

one of the meetings, I was called Chicken Little for saying we need to get

something in place," she recalled.

Since the terror attacks in Brussels last March, iJet CEO

Bruce McIndoe has seen a definite shift in attitudes among corporates,

specifically in Europe. "That was the watershed event," he said. The

attacks hit not only the airport but also local transportation. "A lot of

companies have local nationals in Brussels, and that made this ... become a

people issue, not just a travel issue." McIndoe believes a major event in

the U.S. will have a similar effect on companies in North America.

Half of survey respondents said travelers have expressed

increased anxiety levels about safety and security while traveling on business

during the past three years. The more a company's travelers voyage outside the

U.S. or the more those travelers experience medical or security disruptions,

the more they expressed such anxiety.

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

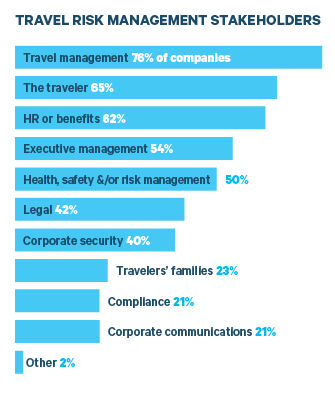

Who's Tasked with Travel Risk Management?

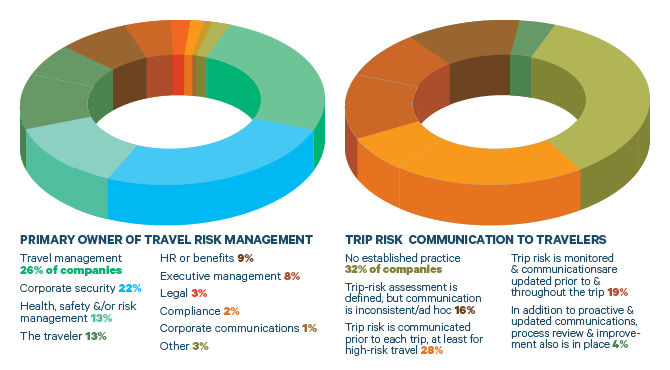

Within each organization, the party primarily tasked with

traveler safety and travel risk management depends on program size. For smaller

programs with less than $10 million in annual travel spend, the responsibility

rests with travel management in 26 percent of companies. It rests with the

traveler in 21 percent of companies and with executive management in 14 percent

of companies. For larger midmarket and large programs, the responsibility more

often falls to corporate security and then to travel management or to health,

safety and/or risk management.

Senior sourcing manager Randy Griswold is a key point person

on travel risk management at Tupperware, which falls in the category that

spends $50 million or more on travel annually. The company has a dedicated risk

manager, but Griswold works with her and the legal department to improve duty

of care for key trip types and destinations.

Two-thirds of survey respondents have taken on more

responsibility for traveler safety and traveler risk management during the past

three years. Even in large programs, which more often have internal corporate

security or risk departments, travel buyers and managers' responsibility for

travel risk management has increased. "These large companies are starting

to address the problem more as a crossfunctional area," said International

SOS EVP Tim Daniel. "Travel managers are being brought into a conversation

that has probably already been going on that they just weren't necessarily part

of."

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

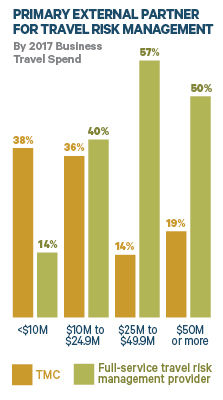

Primary Travel Risk Management Partners

Travel management companies are the primary external partner

for travel risk management for 32 percent of the survey respondents, while 29

percent rely primarily on full-service travel risk providers and 18 percent

rely on traveler tracking or risk messaging platforms. "For people who are

looking at the world through a travel lens," said Daniel, the TMCs are

there and they're already providing a lot of service."

The larger a travel program got, the more it relied on a

full-service travel risk provider and the less it relied on a TMC. McIndoe

suggested organizations across the travel-spend spectrum will shift from TMCs

to full-service risk providers in the coming years. "We see it changing

every quarter," he said. "When it's just travel, you can put it in a

box and put it in the corner. More and more companies are broadening the

responsibility."

Tupperware is transitioning to a new TMC, ATG, and Griswold

intends to work with iJet through ATG. Kaffenberger, who described CTI's travel

risk management program as "embryonic," is shopping around for a new

TMC partner and for a risk management provider, but she intends to contract

with each separately. "In talking to travel risk providers, they suggested

that because our [travel] program is so immature, we should keep our risk

management products separate of our TMC until we've established what TMC we're

going to use and what method of booking we're going to use," Kaffenberger

said. She added that doing so would give her flexibility if she decided to

change again down the road.

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

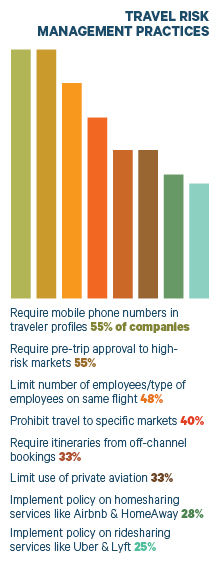

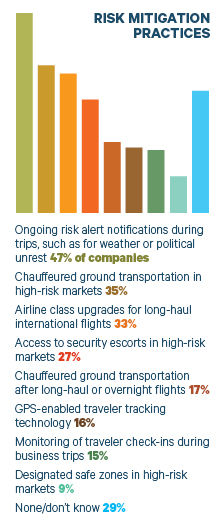

Common Practices: The Good, the Bad & the Ugly

The majority of respondents to BTN's survey require pre-trip

approval for travel to high-risk markets and require mobile phone numbers for

traveler profiles. However, a full 36 percent communicate or implement policies

inconsistently. Only 17 percent fully integrate policy into corporate processes

and regularly review them for improvement.

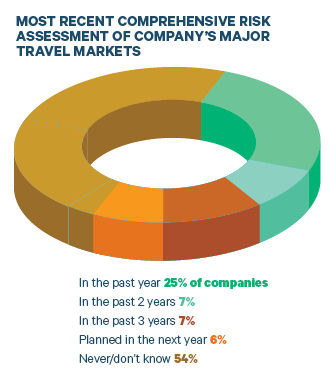

Assessing Risk

Though many programs have some measures around travel risk

management and traveler security in place, more than half said their

organizations have never conducted—or they didn't know if they had conducted—a

comprehensive travel risk assessment of their major travel markets. A quarter

had conducted a comprehensive assessment during the past year. "It comes

down ultimately to resources and money," McIndoe said. "A lot of

companies will go with a provider and put some basic procedures in place, and

that's it."

Kaffenberger said a comprehensive assessment is on her

triage list for the next 12 to 18 months. "I want to know if we are

heading in the right direction and what things I may have overlooked in my

quest for a risk management program," she said.

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Training & Education

Just over half of respondents said their companies don't

offer specific travel risk management training or they weren't sure if their

companies do. That share increased to 62 percent among programs with less than

$10 million in travel spend, a somewhat troubling trend given that 20 percent

of that group said travelers are primarily responsible for travel risk

management.

Daniel said a lot of companies struggle with questions like,

"Do we really need training?" and, "Is it worth making busy

employees do one more thing?" He explained, "There's the belief that

there's not the return on investment."

McIndoe also encounters a lack of investment in education

and training. "The highest return on investment that you can make in a

travel risk management program is to properly educate and train your travelers

to make the right decisions in the moment versus getting themselves into

trouble," he said, "because then it becomes a very expensive

proposition."

Vetting Suppliers

Most respondents haven't changed the intensity with which

they vet car rental, air, hotel, TMC and insurance providers during the past

three years, which didn't surprise Daniel. "If you're going to screen

suppliers, you have to have some sort of standard, and that's usually linked to

a policy and thinking about … 'What result are we trying to achieve and what

are the criteria we want to use?' I don't think a lot of organizations have

sophisticated policies for that sort of exercise. Then there's the work

involved to do it, and the tools and the ways to do that are still evolving."

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Griswold recently removed two air carriers and multiple

hotels from Tupperware's global suppliers. The Global Business Travel

Association's hotel RFP model includes a safety and security section, but

McIndoe said many sourcing departments don't know what to do with the data and

thus ignore it. Griswold, rather, vetted hotels manually, booting properties

with low room nights in riskier areas.

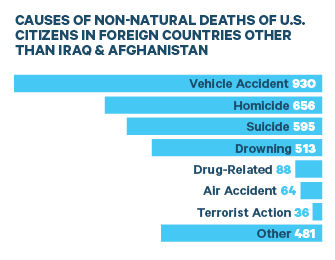

Changing the Conversation

World events have led companies to pay more attention to

traveler security and travel risk management, but McIndoe and Daniel said the

discussion shouldn't be about just the big incidents. Both pointed out that a

traveler is more likely to die in a car accident than in a terrorist attack.

And while not all emergencies result in death, U.S. Department of State

statistics back up the assertion. Between Jan. 1, 2013, and Dec. 31, 2016, 28

percent of non-natural deaths of U.S. citizens in foreign countries other than

Iraq and Afghanistan resulted from vehicle accidents. About 1 percent were from

terrorist actions.

Source: Deaths reported to U.S. Department of State from 2013 to 2016

Source: Deaths reported to U.S. Department of State from 2013 to 2016

"We need to make this a more personal story

in terms of how we approach travel risk and a more everyday story," Daniel

said. "That is where we see companies trip up. They're not necessarily

prepared to deal with the everyday stuff with the resources that they need."

Part of having the right resources in place, he added, is making sure travel

managers aren't trying to tackle travel risk management alone. If they do, they'll

miss out on the strengths colleagues can bring to the conversation. He noted, "The

best programs require multiple people sitting at the table."