Returning even 50 percent of business travel to the market would be a huge boost for the industry.

In Delta Air Lines’ most recent earnings call, president Glen Hauenstein said the carrier’s third-quarter business travel volume was about 15 percent of its 2019 level in the same period but was "trending up across all industries." Similarly, Southwest Business VP Dave Harvey told BTN that business travel, while still lagging leisure, has seen a "nice pickup" since Labor Day.

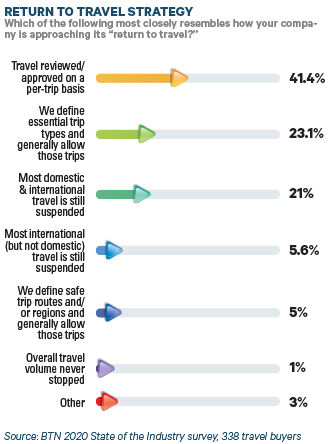

Companywide travel bans have become less common since the beginning of the pandemic, Harvey told BTN. Indeed, BTN’s State of the Industry survey found just 21 percent of travel managers reported their domestic and international travel remains suspended, and 5.6 percent said only their international travel is suspended. That compares with GBTA poll numbers in late March that showed 96 percent of responding companies blacking out travel.

While travel suspensions are down, 2021 corporate travel volumes clearly aren’t coming back to pre-Covid levels. Not least because travelers themselves may be reluctant. One-third of travel managers surveyed by BTN said "many" of their travelers were hesitant to get back on the road, while 11 percent said "almost all" were hesitant. Still, plenty of companies and plenty of travelers say they want to travel.

"We know from conversations and workstream, our road warriors are very eager to get back to traveling and have pent-up demand to interact with people," said Pacific Life Insurance corporate travel manager Sarah Campbell.

ZS Associates meetings and travel manager Suzanne Boyan agreed. "I think most of our folks are excited to get back on the road," she said, adding that her firm expects an uptick in its 2021 travel volume because of more client demand for in-person meetings.

Like those prominent CEOs, many travelers believe they are not as effective virtually as they are in person, especially when it comes to sales and client meetings. Business and service professionals also miss all the subtle and informal opportunities of gathering information and skill development—all of which are offshoots of the trips, Strachan said.

For now, both Pacific Life and ZS Associates are allowing mission-critical trips. "We’re allowing travel by car when it’s not possible to meet business objectives remotely, is necessary to maintain business relationships, sales, inspect assets or things that can’t be done in a remote environment," said Campbell, though it should be noted in the time since BTN interviewed her, studies have emerged from Harvard’s T.H. Chan School of Public Health and from the U.S. Department of Defense supporting the relative safety of air travel in terms of Covid transmission risk.

Consulting firm ZS Associates is visiting select clients but also will allow travel for internal reasons like the IT department’s trips to data centers. Just around the corner, said Boyan, a spate of home leave benefits will hit the schedule. "The company will have three hundred people in the air between now and the end of the year," she said.

There’s a nexus of factors that will get companies moving, according to Strachan: "It’s geography vs. industry vertical vs. their own internal focus [that] brings travel back faster or slower," she said.

Size also may be a significant factor. Small companies, which are more growth-driven, are back on the road and traveling at half or maybe a little more than half of their 2019 volume, according to Areka’s Miller. Large companies, she said, are still very risk-averse to resuming travel. "They are not promoting travel. They’re traveling on a need-to-travel basis, [which is often] 5 percent to 10 percent of their previous volume. Those are the companies focused on a formal return-to-travel plan," she said.

Microsoft offers a case in point. Despite the CEO’s developing distaste for virtual meetings, the company’s mega-travel program, which claimed $440 million in global air volume in 2019, according to BTN’s Corporate Travel 100, hasn’t tipped past 5 percent of "normal" volume since March, global director of travel, venue and payment Eric Bailey told BTN in September.

Even so, he echoed his senior leadership when describing how travel should evolve: "Travel will eventually return, but [it] will come back in a different way. It will be about building the relationships. Just purely sharing content is not something you need to do in person anymore," he said. In other words: You can do that transactional stuff by other means.

Creating the Post-Covid Travel Program

For the travel that does return in 2021, programs are evolving, with a

focus on communication, duty of care and a closer relationship with

risk management partners. READ MORE

Bringing It All Together

With renewed attention from the C-suite and a laser focus on traveler

care, has Covid-19 underhandedly delivered the support travel programs

need to realize their best form in 2021? READ MORE