2020 has been a deeply paradoxical year for travel management companies. Many have emerged with enhanced credit to their reputations for looking after customers during the coronavirus crisis but often with potentially terminal impact to their finances.

Those losses are explained in part by a second paradox. Transaction fees, of which there may be several for a single trip, are the most common way for corporate clients to pay their TMCs. But in 2020 there have been very few bookings—and, consequently, catastrophically fewer transactions—to attract fees. Yet there still has been plenty of work to do, including managing duty of care responsibilities, sourcing information on travel restrictions and handling credits and refunds.

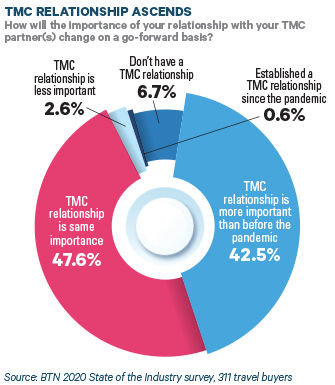

Indeed, more than 42 percent of buyers surveyed by BTN said their TMC relationship is more important now than before the pandemic. That's a huge surge compared to other supplier categories. Drilling further into which TMC services were considered the most important, it wasn't the booking and ticketing.

Buyers rated "managing service disruptions" and access to "experienced, knowledgeable travel counselors" as the most valued services provided by their TMCs. Both are high-touch requirements that might be expected to command a premium. Indeed, nearly 94 percent considered experienced travel counselors to be "critical," "very important" or "important" to their programs going forward.

In the age of Covid-19, those high-touch services are set to expand significantly, and by no means will all of those services be automated into online booking tools, though many TMCs and technology providers are working on solutions.

In the meantime, "customers have been moving [away from] online bookings and doing everything offline because so much information is required," Nina & Pinta managing partner Jo Lloyd told BTN. "I don't think that is going to go away until we get back to some semblance of normality."

Albert Taras, president of TCG Consulting, agreed. "We see agencies with 30 percent to 40 percent of the work they are doing as not transaction-related," he said. That means 30 percent to 40 percent of the labor translates into no revenue.

Virtually, every senior agency executive BTN has interviewed in the past six months has voiced the same concern.

Something's Wrong, Not Just Covid-19

According to 2019 research from BTN's portfolio mate The Beat, 83 percent of travel agency relationships went into 2020 with a transaction fee model. Just 6 percent used a "management fee" model (also known as "cost-plus") and there were a smattering of other configurations, like subscription fees or even "no-fee" scenarios for booking and ticketing that rely on servicing the bookings to bring revenue.

While there were inklings at the time of structural weaknesses, business travel was thriving, and there was little incentive to reconfigure.

In late 2019, "buyers, consultants and agency execs [said] transactional pricing persists because, well, it works," wrote The Beat researchers. "Transaction-based pricing gives clients a pay-as-you-use model that can be clearly defined in contracts. Transactions can be counted, independently verified and audited. They're priced in a predictable way, which is good for forecasting and budgeting—both at the agency and the client level."

The research went on to explain, "For corporate sourcing departments, transactional pricing gives a unit of comparison to assess competing offers." It quoted an industry executive saying transactions present a "clean expense and reconciliation model," and it noted that this point "is particularly important to companies that don't have a central budget for travel management services. With per-transaction fees, travel management costs are dispersed across the company and incurred by users."

While all of that is correct, the last 6 months have upended that value narrative.

UK TMC membership group the Business Travel Association jointly released a white paper last month in collaboration with consultancy Nina & Pinta. ‘Time for Change—Looking at the TMC pricing model in 2020' called the pandemic a "catalyst" to reveal TMC fee model weaknesses, but posited "the need for a change to TMC pricing has been evident for years."

At its most fundamental, the right model comes down to distributing risk in an equitable way. The transaction fee model put all the risk on the TMC should travel suddenly bottom out. Perhaps an agency could absorb this for a single client, but with a global wave of cancelations and no future bookings, the transaction fee model immediately cratered. So where does the industry go from here?

Lloyd underscored the continued relevance of the management fee model, which is favored by some customers with volumes large enough to merit a dedicated team of travel counselors. The cost of providing that service can be calculated accurately—a profit margin agreed on top and the client pays the two combined in a single lump sum, often centrally budgeted. Management fees remain valid, said Lloyd, because they are built "on a very transparent relationship."

For companies with smaller spend or inability to fund centrally, however, a different solution is needed. Much touted during 2020 is a subscription fee, which the BTA white paper describes as "essentially a monthly retainer for services. For the TMC, it is an attractive model as it helps manage cashflow." But as The Beat research pointed out, the right solution must offer a "clean expense and reconciliation" for the corporate.

That's where Lloyd saw weaknesses. Though she went in thinking subscriptions fees might be the future of the TMC commercial model, her view changed quickly. "It's hard to quantify the benefits for the corporate," she said. "If the corporate is subsidizing the bill centrally, that's a very big cost; if you pass on the cost to budget holders, what happens if they only travel twice a year? I think the way forward instead is to modernize the transaction fee."

For Lloyd, modernization means a hybrid fee, consisting of a central contract fee to the corporate entity built from an extensive menu of services, plus a transaction fee on top for reallocation to travelers' budgets.

FCM Travel Solutions global managing director Marcus Eklund said discussions with FCM clients are also pointing towards a hybrid, but a slightly different one. Again, there would be a transaction fee for each booking on top of a baseline of services such as duty-of-care provision, technology and reporting. However, the baseline would be covered by a much smaller subscription fee which would be calculated either per employee or per traveler and, therefore, could be reallocated internally.

"Everyone in the company has it for Microsoft Office," said Eklund, adding that the subscription fee per individual would work out at only a few dollars—"probably less than they spend on pens and paper."

FCM has only a few clients solely on management fee but, unlike Lloyd, Eklund believes this also needs a shake-up because just as transaction fees failed to compensate TMCs when travel volumes collapsed, management fees in 2020 have left clients paying for projected bookings that did not materialize. A hybrid, according to Eklund, balances the risk between both parties.

Will Buyers Re-Align?

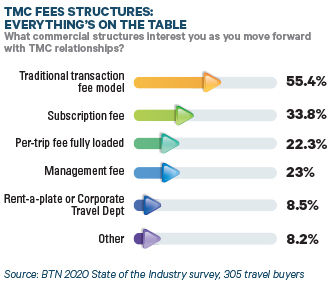

According to buyers, everything is on the table when it comes to TMC commercial models. Asked what configurations they would be willing to discuss, the traditional transaction fee remains most common at more than 55 percent, but buyers were open to other ideas. More than a third said they would discuss a subscription fee and nearly a quarter were willing to consider the management or "cost-plus" configuration. More than one-fifth said they were open to discussing the fully loaded per-trip fee, in the style of some of the next generation all-in-one platforms like TripActions and TravelPerk.

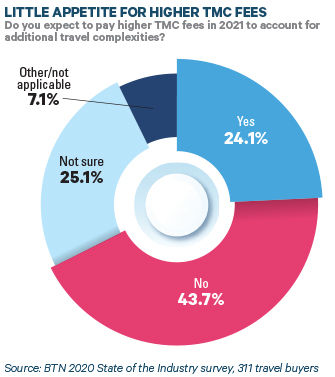

Yet when it comes to actual cost, attitudes among BTN's surveyed buyers were less adaptable—despite the fact they seemed to understand the value of high-touch services for their programs. Fewer than a quarter said they expected to pay higher TMC fees in 2021 to account for additional travel complexities, nearly 44 percent said "no" to the idea of paying more and 25 percent were undecided.

J-C Taunay-Bucalo, chief commercial officer for TravelPerk, believes TMCs will meet resistance to any proposed fee increases and will instead have to accept yet another paradox playing out in the minds of their customers.

"Companies need a lot of help right now because business trips are more uncertain and more complex," he said. "At the same time… they are conducting a review of their costs over the past couple of years and concluding they were paying too much, so they are in this quandary of wanting to save money but wanting to make sure their travelers get more help. You see this ying and yang at the moment, because there is both a health crisis and a pretty certain economic crisis."

Lloyd echoed some of Taunay-Bucalo's thoughts about redistributing value: "I don't know if clients need to pay more; they need to pay differently," she said. But she added, "If they are expecting someone to be on the end of a phone, they need to pay for that. Customers are generally being responsive here." FCM's Eklund shared Lloyd's view. "Most corporates are willing to have a discussion about what a fair model would look like," he said.

Will My TMC Survive?

While negotiations over fee structures and service requirements play out, a more urgent question at hand for buyers is whether their TMC will continue to exist for them to have any negotiations with. "We projected early on in the crisis that 30 percent of agencies would go under or have significant hardships," said TCG's Taras. "We still think there are agencies that would be in trouble even if the pandemic ended tomorrow."

His view is shared by Taunay-Bucalo, who said his company has only been able to maintain a full service because "we have received $140 million in investments. It's very unfortunate but the reality is only the biggest are going to survive. There will be a giant consolidation. The only way for many TMCs not to go bankrupt will be to merge."

TCG is helping clients to understand their TMCs' financial situation so they can assess their viability, but obtaining reliable figures for privately owned companies is very difficult. Eklund's recommendation for managing risk of TMC failure is "to have a plan B. Have a second TMC in mind and liaise internally with your HR department about what you would need to do to provide a back-up service."

Should that alternate TMC be appointed as a precaution now?

"Not in the short term because volume is so low there isn't enough to share," said Eklund.

By the time volume does return, the TMC landscape is likely to look very different. The acquisition of Travel & Transport by Corporate Travel Management—both sizeable players with multinational presences—announced in September is surely only the first in a wave that may play out in the next two years. Perhaps even bigger names will combine or disappear. Disruption, certainly change, is likely for many TMC customers. But opportunities for healthier, more finely tuned relationships could emerge from the upheaval.

Redeploying the TMC Relationship

In whatever way the TMC fee conundrum is resolved, buyers inevitably will re-examine what they are paying for. "As a corporate you have to take a step back and ask, ‘Where do I need my TMC and where don't I?'" said a European travel buyer.

A reassessment of this kind is not confined to deciding which data reports are or are not required. It could also accelerate a trend that was emerging in the couple of years before coronavirus hit, namely for travel managers to become travel technology "architects." This concept entails travel managers not accepting unquestioningly the stack of tech tools deployed by their TMC but instead curating, integrating and customizing their own selection of tools.

“I am seeing right now a lot of corporates sourcing their own technology,” said the buyer. “It’s up to corporates to say, ‘If you’re not offering what we’re looking for, we’ll source it ourselves.' I do foresee more travel managers acting independently of their TMCs.”

For those travel managers pursuing a program architecture strategy, TMC selection criteria will change. TMCs could be judged on their capacity—and willingness—to integrate with tech providers of the customer’s choice. “Some TMCs don’t play well with other companies’ technology,” warned Lloyd. “If you want to bring in a Traxo or a Roadmap, it’s very hard. The TMCs who are open to that are the ones who are going to do well.”

Given the trend toward mandating the TMC and the additional value placed on the channel, Eklund believes “only a small percentage” of the largest corporations will choose such a strategy. For buyers who do, Eklund cautioned: They may find themselves wrestling with the same fee conundrums—such as whether to pay centrally or reallocate to budget holders—only now for a range of service providers instead of a single TMC.