WHY IT MATTERS

A vast majority of employees surveyed by Business Travel News from April 15 to 25 for the BTN Traveler Experience Index characterized travel as a fundamental work enablement mechanism for their current roles. More than 83 percent of 309 full-time workers said that business travel was “important” or “very important” to their job success. More than 84 percent said it was “important” or “very important” to their job satisfaction—and that latter number has become increasingly important.

Companies are reaching for every tool in the box when it comes to retaining employees in tight labor market. The latest jobs report in the U.S. was expected to see hiring rates level off, after downward revisions to February and March hiring rates, but April came in 70,000 jobs over expectations, driving unemployment rates down to their lowest level since 1969. A similar situation in the U.K., in large part driven by the retirement of older workers combined with a Brexit-driven reduction in incoming workers from the European Union has stymied efforts to staff up businesses there as well. Both France and Germany are looking to revise immigration regulations to attract skilled workers into jobs unfilled by citizens. It’s an issue that has businesses upside-down in terms of meeting pent-up demand for goods and services post-pandemic.

A report from the U.S. Chamber of Commerce earlier this month cited flexible work hours, continued remote/hybrid workplace initiatives, mental health and wellness initiatives, home-buying assistance, fertility assistance, pet insurance and a number of other life-enhancing benefits that will sweeten the recruitment pot for prospective workers and help hang onto the workers companies already have.

While travel programs and policies may not be the pivot point upon which employees make stay-or-go decisions about their jobs (though, in some roles, it could be), businesses would do well to scrutinize the management of something perceived by employees as being a central enabler to their success and satisfaction and how effectively that management delivers on employee needs and expectations.

BTN’s Traveler Experience Index

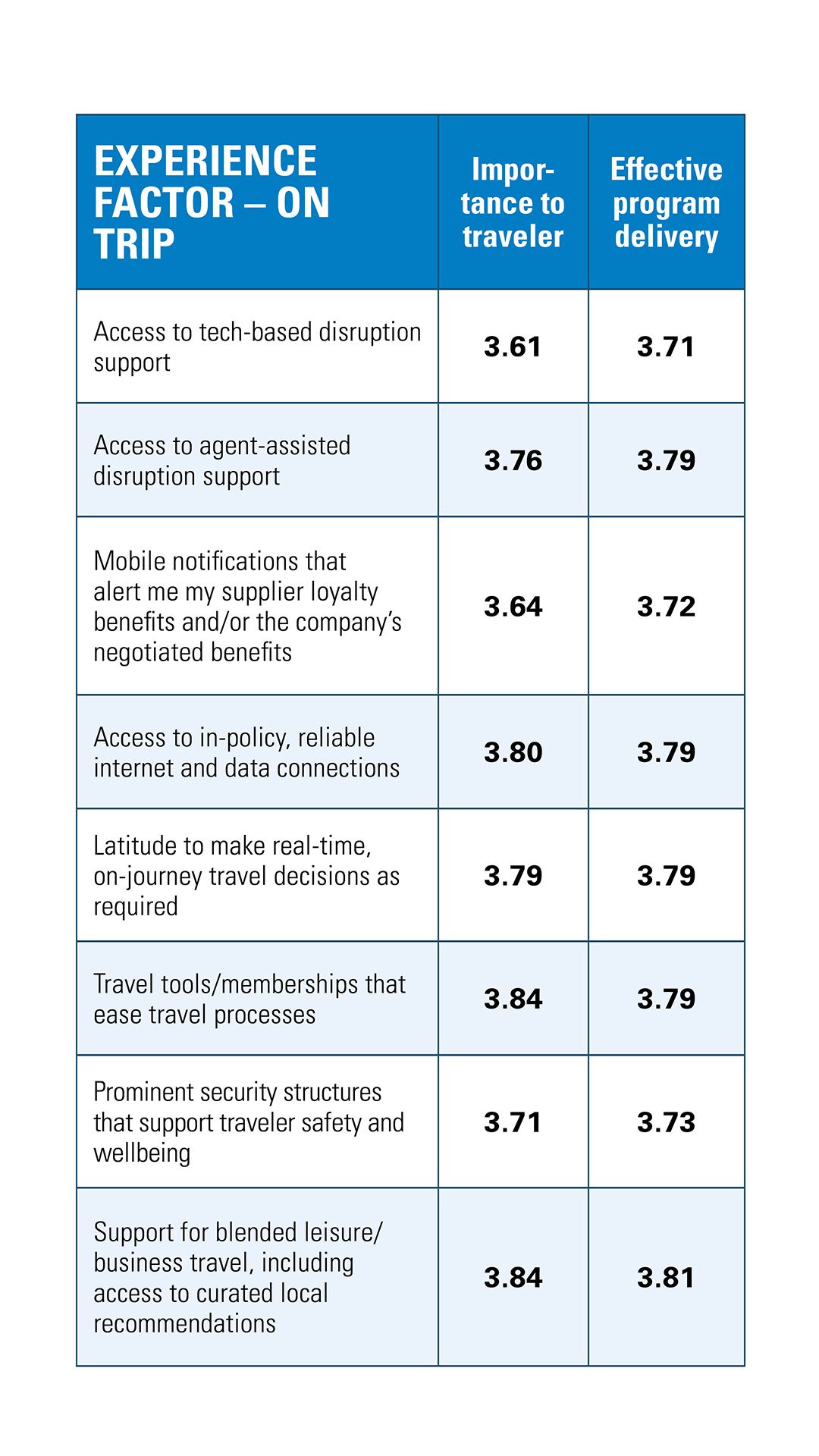

Business Travel News started down that road by fielding BTN’s Traveler Experience Index to 309 business travelers, who have taken at least one trip in the last 12 months and expect to take at least two trips, including air or rail travel and an overnight stay, on behalf of their companies in 2023. BTN asked business travelers to rate 22 business travel experience factors on an ascending scale of one to five on their importance to the traveler as well as how effectively their company delivers on those factors.

The raw ratings aim to identify business traveler priorities when planning, executing and returning from a business trip, but also to identify gaps between those priorities and the support levels offered in their companies’ travel structures—i.e. travel and expense policies, processes, technologies and supplier partnerships. Or, in the case of a small percentage of respondents, how the lack of those managed travel structures also impacts the business travel experience.

From those raw scores, BTN has created an index score that weights the relative importance of each factor to a given group of travelers so that it acts as a multiplier on either effective program support (positive impact) or ineffective program support (negative impact)—and, therefore, magnifies those impacts. The final shift formulates all of those factors and weights into a Traveler Experience Index score on a 1 to 100 scale. A score of 50 would be completely neutral—that the program seems adequate, and while there may not be any passionately negative perceptions of the program, there’s no particular positive impression either. Even the latter may lead to compliance issues if a more compelling business travel proposition is offered elsewhere, potentially through supplier loyalty programs or “freemium” travel tools available in the marketplace.

BTN has opened this tool to all travel managers interested in benchmarking their travel programs via a simple three-step, data-protected process. To access the tool and apply for unique credentials, access the tool here. It is free to use.

The following data set—as well as the demographic-oriented stats that continue the article—provide a view of 309 business travelers whose total response offers travel program managers visibility into common themes driving business travel experience today.

How to read these data tables...

Look for high “importance” scores to understand where travel program changes could have the most impact for the group. And consider how your group demographics might impact their opinions. Low “importance” scores indicate areas that need less attention, according to the traveler. The organization may have other priorities.

Look for low “effectiveness” scores. Anywhere high “importance” aligns with low “effectiveness” signals a prime opportunity. Best-in-class programs should score fours or higher for effectiveness.

Key Trends: The Business Traveler Perspective

The following high-impact factors trended across BTN’s survey sample. Some have been long-standing challenges, but others may be intensifying in the post-pandemic work environment.

Expense Reporting – The perennial pain point of expense reporting landed in the top spot as travelers’ overall most critical concern when it comes to business travel. Efficiently and effectively getting reimbursed for out-of-pocket spending may always surface as a primary concern. More companies, even in the U.S., are moving away from individual bill/individual pay corporate cards and going to a central pay configuration—sometimes to address concerns about the inequity of assuming a highly paid employee will front the liability and eventual cost of, say, an airline ticket prior to reimbursement, as opposed to other realities of highly or moderately paid employees having other obligations for their personal funds.

Curtailing Risk – According to BTN’s Travel Experience Index, business travelers ranked duty of care around such risks as severe weather, political unrest, personal safety risk and lingering concerns around Covid or other disease spread as their third-highest priority among the 22 pre-trip, on-trip and post-trip experience factors in the survey. For several profile types, duty of care jumped higher on their lists. Young business travelers ranked duty of care third in their priorities; for road warriors taking 11 or more trips annually it was second; and for heavy international travelers that concern rose to No. 1. The latter two groups also showed significantly higher levels of concern on the scale of 1 to 5 than other groups.

Blended Travel – That’s not to say employees don’t want to travel—they do. Many want to travel more, at least insofar as they want to leverage work trips as jumping off points for leisure travel. Doing so saves them time, money and is lighter on the environment—though, in truth, sustainable travel came dead last on the priority list for every traveler group. Be that as it may, business travelers voiced in BTN’s survey the importance of blended travel to their overall work-life balance and the desire for their companies to support those priorities with defined policies, sources for recommendations and potentially supplier-extended rates and deals

Compensatory Time – Perhaps to that same goal of work-life balance but emerging in a different formulation, business travelers highly valued compensatory time if business trips spanned a weekend or holiday, time spent on leisure pursuits or with family. More than a handful of survey respondents offered open-ended comments that the biggest challenge associated with business travel was the “time spent away from my family.” To sacrifice that on weekends and holidays as well as workdays, they felt, deserved acknowledgement and flexibility from their employers. While that may not fall entirely under the purview of the travel manager, it may be a discussion point between travel and human resources regarding what is possible with company policies versus individual managerial discretion, which by definition is applied unevenly across the workforce.

Reliable Suppliers – Somewhat surprisingly, the choice of reliable suppliers in the booking tool or through the corporate agency did not rank as travelers’ highest concern. But it was up there with the big issues. Travel managers told BTN that supplier reliability and the ability of travel management companies to support travelers had been a major stumbling block for programs in the preceding months. They spoke of the need to educate business travelers about new realities, but survey results pulled in April show travelers may be getting the message. That said, gaps in supplier performance across air, hotel and ground transportation was another common theme in the survey’s open feedback segment, as was the imbalance of the financial outlay for the level of service business travelers are receiving across the ecosystem.

Five Priorities: By Traveler Demographics

Looking at demographic groups is another way to drill down into diverse needs of travel to get a more granular view. BTN looked at the following groups to find out how different they really are.

Interpreting Importance Ratings & Trends

Business travelers aren’t travel managers, and bringing travel expertise into the data analysis picture is an important piece of bringing value to the travel program and to travelers themselves. It might be tempting to take the results of BTN’s Traveler Experience Index—or, indeed, your own company’s results from the survey if you choose to deploy it—at face value and strive to match certain traveler priorities one-to-one with services or tools. And there may be certain areas where that is clearly the solution—matching heavy international travelers with additional human support services for booking complex itineraries would be one obvious example. Bringing more automation to manual expense reporting processes would be another. There are certainly more.

One-to-one solutions aside, travel managers should also consider travelers’ “importance factors” through the lens of innovation opportunities, where there may be an unexpected alternative to meet a need that doesn’t have an obvious solution. These are jumping off points for discussion with travel management company partners and, certainly, travelers themselves to see how new or existing technologies and services might improve the traveler experience—or, indeed, if there is education to be done around the services and support the travel program already provides.