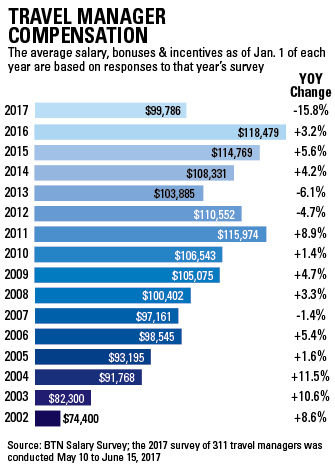

- The average travel manager salary has decreased 15.8

percent since last year's BTN Salary Survey.

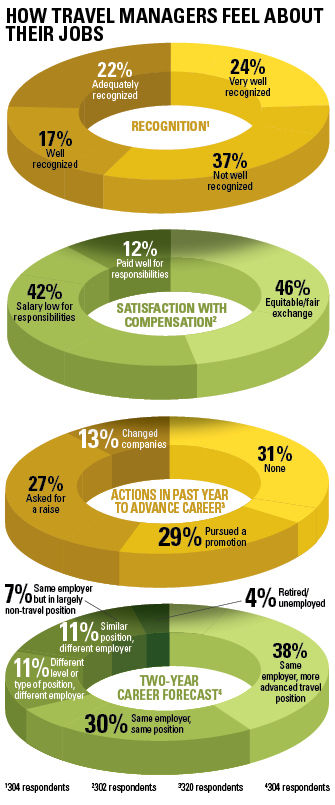

- Even with lower salaries, general satisfaction with

pay is about the same as last year's survey. Plus, twice as many respondents this

year said they were "very well recognized" by their companies.

- So what gives? The profile of the average travel

manager is changing as younger professionals fill the ranks and small and midsize

enterprises become more active in travel management.

For the first time in the 34 years since BTN began measuring

travel manager salary and job satisfaction, a massive decline in travel managers'

salaries has occurred. Respondents to this year's survey reported salaries 15.8

percent lower than those who responded to the 2016 survey, and yet they were as

satisfied with their compensation as their richer 2016 counterparts had been a year

earlier. Moreover, more than twice as many 2017 respondents reported that they were

"very well recognized" within their organizations. So if companies have

not devalued the role of the travel manager, what gives with the cratering salaries?

A deeper dive into BTN's 2017 Salary Survey numbers suggests some intriguing shifts.

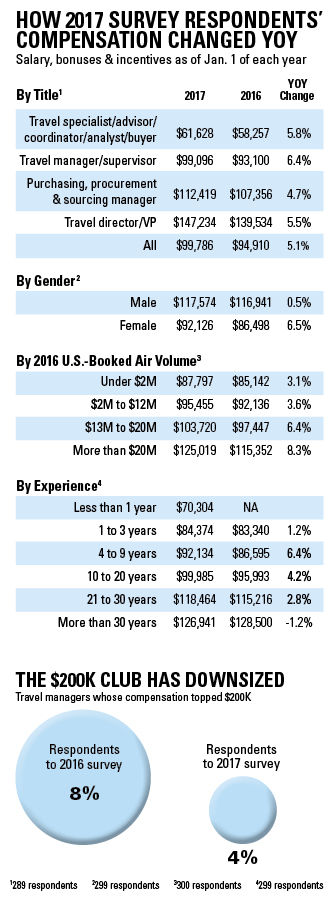

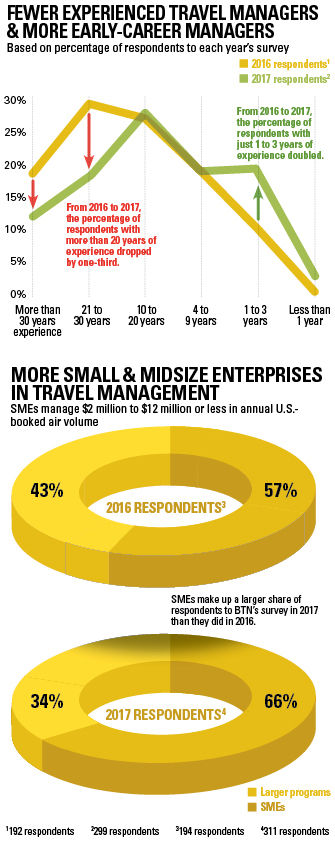

Are you experienced? That's a question BTN has asked travel managers

for years, but this year's survey counted a lot more who answered no. Among 2016

respondents, 47 percent had worked as travel managers for more than 20 years. This

year, that group dropped by more than a third to 31 percent. On the other end of

the spectrum, those with three years of experience or less more than doubled, rising

from 11 percent of the 2016 respondents to 23 percent of 2017 respondents. In addition,

the percentage of very high earners dropped; individuals earning $200,000 or more

in total annual compensation made up 8 percent of 2016 respondents. In 2017, the

$200K Club comprised only 4 percent of respondents. It stands to reason that the

highest earners were also some of the most experienced travel managers in the business,

counting more than 20 years on the job. As those ranks thin, either through retirement

or moving on to other senior positions, less experienced travel managers appear

to be filing in behind them, driving down overall compensation levels.

Small and midsize enterprises also are entering the market in

a big way. The total number of respondents to BTN's survey grew from 194 in 2016

to 311 in 2017, and many of those additional respondents represented SMEs; in 2016,

57 percent hailed from SMEs, and in 2017, 66 percent did. SME travel managers have

smaller travel volumes and fewer resources. They also hold various positions within

the organization from administrative assistant to HR executive, but some of these

positions traditionally pay less than a full-time dedicated travel manager. SME

travel buyers managing U.S.-booked air volume between $2 million and $12 million

reported average salaries around $95,000. Travel managers at companies managing more

than $20 million averaged upward of $125,000. Thus, the influx of SME travel managers

taking the survey in 2017 pulled total average salaries lower in year-over-year

comparisons.

The Young & the Restless

Attendance at the last three Association of Corporate Travel

Executives global conferences echoes the new experience-level dynamic BTN's survey

found. According to ACTE, 35 percent identified as first-time attendees in 2015,

45 percent in 2016 and 43 percent this year. It's notable, however, that just as

participation in BTN's Salary Survey ballooned by more than half this year, attendance

at ACTE's 2017 conference grew by 53 percent. So while the percentage of first-time

attendees held steady from 2016 to 2017, many more rookies were in attendance in

raw numbers.

ACTE executive director Greeley Koch connected the dots:

"We are seeing a significant amount of retirement. There was a generation of

travel managers that came around in the '80s or '90s when [travel management] became

a true profession. These are the people who developed the best practices and philosophies

in place today, but at some point they move on and we have to make way for new people

and new ideas."

Not long ago, there was concern about who would take the travel

management reins, even as the benefits of managing travel were becoming clearer

to organizations, Koch said. "There was a bit of time a few years ago when

being a travel manager wasn't a clear career choice, that 'travel manager' as a

profession was going away. If you look at it today, it's different. I sat next to

a younger travel manager in a local forum while a more senior travel manager was

on stage talking about [passenger name records]. His reaction was, 'I don't care

about that. I want to put the right tech in their hands and make sure their trip

is productive.' You can be that now: part travel, part tech. It makes it all more

exciting."

Coach senior manager of global travel Rosemary Maloney echoed

Koch's observations. She has held travel management roles for six years and has

participated in the Global Business Travel Association's Ladders program, a networking

and education forum for up-and-coming managed travel professionals looking to fast-track

their careers. "Travel management is definitely more than saving that last

nickel," said Maloney. "There's so much interesting work to do around

data and traveler engagement. I've seen a lot more young people coming into the

industry and people coming over [to the buyer side] from other parts of the industry

because the buyer side is getting cool."

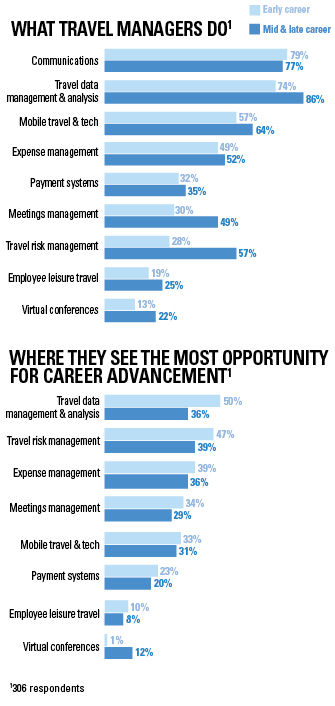

While experienced travel managers have been working with data

consistently, according to BTN's 2017 Salary Survey, just 36 percent of them targeted

data analysis as key to career advancement. Meanwhile, half of newer travel managers

plan to dig into data, as Maloney is doing. She's gaining new insights into her

program and into traveler behavior with a new business intelligence tool that draws

in data from multiple sources. Like 47 percent of the early career survey respondents,

Maloney also points to risk management as a practice that a new generation of travel

managers will need to master. "This has become a major part [of the job],"

she said.

Small & Midsize Enterprises

ACTE's Koch also pointed to the midmarket as a significant source

of growth for managed travel. "SMEs [start to recognize] the significance of

travel spend as they grow because the spend grows along with them," he said.

Also, "more SMEs are playing in the global field. That means more cost, more

expense. They are saying 'Wait a minute, we need to look that.'" And yet, the

CFO at a SME is not always focused on the cost side of travel but rather on the

revenue side of the company's core business, Koch noted. However, "when you

have a global footprint, the expense gets attention."

That's the case for Hakkasan Group corporate program manager

Samantha Rodriguez, whose previous "dabbling" in travel management in

a procurement role at her previous employer clinched her current position that,

along with other responsibilities, includes managing Hakkasan Group's $3.5 million

in total travel among approximately 50 travelers in the U.S. "In my interview,

when I spoke about my previous travel experience, I was hired. I found out later

they had just signed on to [a TMC] and they said, 'By the way, we need someone to

head this up for us, and it's going to be you.'"

Hakkasan Group operates more than 50 restaurants, clubs and other

hospitality venues in major international markets in Asia, Europe, the Middle East

and the U.S., so hosting business guests, hiring and booking travel for models and

talent and supporting business relationships all come before cost considerations.

"That was one of the first things I learned here,"

said Rodriguez. "It's always 4- and 5-star hotels, and there's always going

to be a cost for London, San Francisco; these are the markets where we do business.

As we get new executives and people with more corporate background, they want to

know why we spend so much on travel. I like that. We already use [videoconferencing]

for internal meetings, but I hope we can get to a place with travel management that

we are focused on financial savings, security and making people comfortable."

For now, she says the CFO is more focused on growth.

Getting an Industry Education

As much as the new generation of travel managers will bring fresh

ideas and tech savvy to the practice, there's some concern that a lack of education

around the basics—such as PNRs, industry financial models and some of the more esoteric

operations and supplier-to-supplier relationships—could leave younger travel managers

prone to error and/or bad deals.

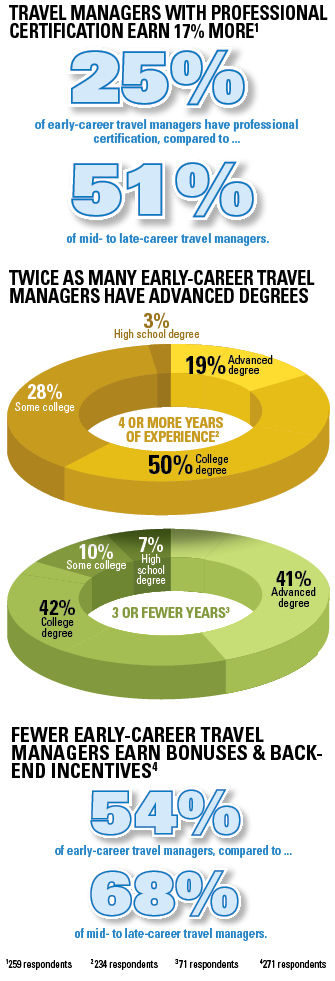

BTN 2017 Salary Survey data showed that early-career travel managers

enter the field with much higher levels of formal education than their peers with

more on-the-job experience. Indeed, 41 percent have advanced university degrees,

compared to just 19 percent of their older counterparts, who may have come into

the industry via their role as a travel agent or other hospitality role. Yet in

terms of career advancement, the BTN 2017 Salary Survey shows, as it has year after

year, that industry certification programs yield more highly paid travel managers.

This is a big opportunity for early-career individuals looking to get ahead.

Just 25 percent of early-career travel managers hold

an industry certification, such as Certified Corporate Travel Executive or Global

Travel Professional. Meanwhile, 51 percent of mid- and later-career travel managers

have such certifications. Travel managers tend to get certified after eight or nine

years in the business, but why wait to earn more?