T&E generally accounts for 10 to 15 percent of a company’s expense base, but the bottom line isn’t the only factor in travel policy. American Express Global Commercial Services’ Global Client Group card transaction data reveals four trends about employee preferences and behavior that can help CFOs and finance, travel and procurement executives manage T&E while also ensuring that travel policies are employee friendly and do not inconvenience the larger employee population.

Bleisure

Bleisure trips, travel that includes two weekend nights at the start and/or at the end of a trip, are growing in popularity. Such business travel extensions happened on around 10 percent of trips for large and global Global Client Group clients in 2017. Additionally, the likelihood of an employee adding personal travel days to a business trip increases the longer the trip distance, the most popular route being trips between San Francisco and London. On this route, employees are 29 percent more likely to extend a trip for leisure.

This can benefit everyone because it often supports a more positive employee experience. It also can lower a company’s cost per mile for airline tickets. On these trips, airline tickets can often be 25 percent lower because the employee flies on a weekend rather than a weekday.

That being said, bleisure trips can cost more if there are charges for extra nights in a hotel, or for additional meals and local transportation. Also, the average daily rate for hotels for bleisure trips is 7 percent higher than for traditional business trips. Companies need additional controls, beyond policy guidance, to ensure the overall cost of travel is not higher than pure business travel while still prioritizing the employee experience.

Airline Booking Behavior

Travel policies of global companies generally encourage employees to buy airline tickets as early as possible, operating under the assumption that buying far in advance is cheaper. In 80 percent of the trips taken by employees of Global Client Group clients, however, the most significant savings occurred between eight and 14 days prior to travel, while only modest savings were gained from bookings made farther out.

Sharing Economy

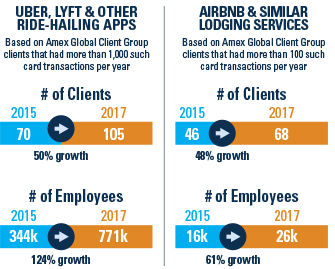

Global Client Group observed a 124 percent increase from 2015 to 2017 in clients’ employees using ride-hailing apps, indicating increased employee preference for it over other forms of transport. Ride-hailing’s share of total ground transportation costs is over 23 percent, and its share of transactions is 52 percent.

Similarly, the number of employees using alternative accommodations services like Airbnb grew 61 percent over the same period. Interestingly, the market share of such spend is still in the lower-single digits, indicating that it has yet to become mainstream among corporate travelers.

Still, with increasing adoption of both online hospitality and ride-hailing apps, companies should alter their policies to include them.

Policy Compliance

One reassuring finding has proven itself time and again: Card misuse is highly concentrated among a relatively small number of employees. Among Global Client Group transactions in 2017, 2 percent of employees contributed to 80 percent of questionable spending. We also found that questionable behavior strongly correlates to other aspects of bad corporate card use, such as payment delinquency. Card members who exhibit questionable spending are six times more likely to be 60-plus days delinquent on their corporate card payments. Using data, insights and tools can help companies better manage expenses by focusing on this limited group and avoid burdening the full organization with unnecessary policies.