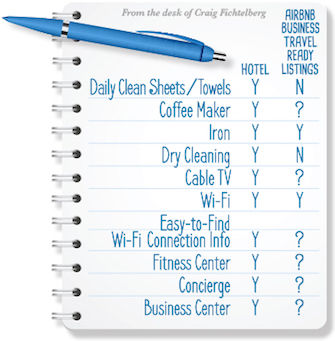

How would you define convenience for a traveler checking

into a hotel for business travel? Is it knowing that there will be someone

waiting at the front desk to assist you 24/7? Is it providing standard in-room

amenities, such as daily clean sheets and towels, a coffee maker, an iron, dry

cleaning, cable TV and Wi-Fi? Or maybe convenience is better characterized by

an on-property fitness center, bar, concierge or business center. Regardless, hotels

around the world have established a standard they all must maintain in order to

attract business travelers.

Airbnb has done a phenomenal job disrupting the hotel space.

The company has added diverse and robust supply at a competitive price point.

It has created an easy-to-use booking tool to distribute its inventory to the

public. But, thus far, Airbnb has struggled to penetrate the highly

sought-after business travel market. It is no easy task to take a diverse group

of homeowners and establish a reliable level of consistency from one property

to the next, but consistency is exactly what business travelers expect.

Business travelers do not have time between meetings to track down room keys,

find business centers or search for Wi-Fi networks and passwords.

On average, business trips are short and time is vital. The

Airbnb convenience bar is lower than hotels' and inconsistent from one property

to the next. Airbnb will need to raise the convenience bar across its

properties to achieve the business travel adoption the company is striving for.

While Airbnb has struggled with business travelers, Uber has

prospered. A Certify analysis of the business receipts it processed in 2016

showed Uber to be the most expensed service while Airbnb made up less than 1

percent of expenses in the lodging category. Both Airbnb and Uber are

disruptors in their respected spaces. Both come in at lower price points than

their traditional competitors. Both have easy-to-use mobile booking tools. But,

the reason Uber has seen adoption with business travelers and Airbnb has not is

the convenience factor. While Airbnb is struggling to provide a consistent

level of convenience, Uber's combination of lower cost and higher convenience

fuels business travel adoption.

In pursuit of this convenience level, Airbnb is developing

partnerships with concierge companies and services to mimic the hotel

experience. This is a step in the right direction. Once it can establish

consistent convenience across the majority of its business properties, both travel

management companies and booking tools will be pressured to find ways to

incorporate Airbnb content into their regular booking paths.

At this point, the burden is on Airbnb, and

hotels have no intention to wait around. Instead, they're taking steps to

enhance traveler and guest convenience. If Airbnb can raise its convenience

factor at a faster pace than hotels, parity will eventually reign between hotel

offerings and Airbnb properties. At that point, Airbnb will be as strong a

contender in the business travel space as Uber is today.