The first commercially available online booking tools for corporate travel developed in the 1990s. They trailed consumer online booking tools by three or four years but by the early 2000s were recognized as the inevitable future for corporate travel booking, as they focused on driving down costs and shopping/booking time.

A technology-enabled, traveler-booked reservation in 2010 cost a corporation $4 to $8 in agency fees, compared with $15 to $65 for an agent-assisted booking through a call center. This comparison is the most recent these writers could find. It wasn't completely fair at the time, and still would not be today, considering that self-service online bookings generally are simple point-to-point bookings. Those higher-fee agent bookings were complex and likely still would need agent intervention today.

The potential for savings from online booking should be calculated not based on total booking volume but according to a company's travel patterns and what can be shifted to an online tool realistically. For most companies, however, at least 80 percent of bookings are eligible for online booking, which makes the business case for adopting such a tool clear. Implementation of online booking tools now is the norm rather than the exception for corporate travel programs.

That's not to say OBT adoption has been a straight shot. There has been resistance particularly in high-touch environments like law firms and consulting firms, in which personal agent assistance remains highly valued. The idea that self-booking creates a productivity vacuum is well-trodden turf. Yet reductions in agency fees and "visual guilt"—the idea that employees opt for lower airfares or hotel rates when they see them in booking displays—have proven compelling to corporates looking to reduce costs.

On the agency side, the shifting landscape for fees upended financial models. While some travel management companies tried to stand their ground with personal service, future-minded agencies adapted to become partners with technology providers like Sabre's GetThere; Concur Cliqbook, now SAP Concur Travel; and others to become resellers and implementation experts. They also recalibrated agent services and redesigned fee structures to align with new market realities.

The relationship between online booking capabilities and TMC services and fees is complex and ongoing. As booking tools evolve with mobile platforms and more powerful technology like artificial intelligence and machine learning, the value of the human travel agent and agency services changes, as well.

Beyond Booking Travel

Policy Configuration

Unlike consumer booking tools, corporate travel booking tools do more than enable shopping, reservations and transactions. They also automate corporate travel policy. Connected to a traveler profile system, the booking tool can register the traveler type and, therefore, which policies to apply (see Knowing the Traveler section below). From there, booking tool settings automate what air, hotel and car rental content is displayed to the traveler, as well as how it is prioritized—potentially by price but also by preferred suppliers if the company has contracts in place. Less common but also possible is to block certain classes of travel like luxury or basic economy, often based on the employee's level in the company. A booking tool also could block any content above a certain price, such as airfare over $500 for a domestic trip, as well as certain locations for traveler safety reasons.

The simplest booking tools—or the simplest settings within a more sophisticated platform—may incorporate just rate caps; travelers either cannot book more expensive rates or have to justify the expense to their managers. All corporate booking tools should make clear in the booking path which of the rates or suppliers displayed are in and out of policy, regardless of the rate. Some methods are to color-code, tag or display a corporate's preferred rates next to the rack rates.

Corporate travel booking tools also must include some mechanism to alert travelers to out-of-policy bookings. A few employers block such bookings. Most tools automate out-of-policy-booking justifications by providing "reason codes" for travelers to choose from or prompting them to enter their own reason for requiring that specific travel accommodation. Justifications can be pro forma and end up in a monthly report, or a company may configure a booking tool to route approval for an out-of-policy booking to the traveler's manager or another designated approver. Some companies route all travel bookings for approval, whether they are in or out of policy. Mobile tools and the ability to support complex approval hierarchies have reduced approval wait times. Corporate travel booking tools also should accommodate corporate travel arrangers who book travel on behalf of other employees.

Knowing the Traveler. Traveler profile systems store travelers' personal information like their legal first and last names, addresses, birthdates, passport information, emergency contacts and frequent-flier program memberships. Traditional profile systems reside in the GDS and are closely integrated with agent desktop tools and with self-booking tools. Fundamentally, they provide information that suppliers and regulators require to enable travel, but HR tools may feed additional corporate information like department and cost center. They also mean users do not have to enter personal and corporate information each time they book.

These profiles provide business travel technology providers an opportunity to drive corporate travel personalization. A new breed of machine learning tools like TripActions, Lola and 30SecondsToFly are blurring the lines between profile systems and corporate travel booking tools. They require users to register upfront their personal info, preferences and memberships, and they build on that with "revealed preferences," i.e., the booking behaviors and preferences exhibited through actual bookings made in the tools.

TMCs are hot for profile innovation, as well. FCM just increased its investment in 30SecondstoFly, and American Express Global Business Travel purchased KDS two years ago, including the Neo booking tool, which the mega TMC is both refining and using as an engine to power traveler recommendations across its entire platform. BCD Travel has invested in a cloud-based SAP customer relationship management tool to power its profile system and drive toward personalization within a framework of data security and consent. Profile system builders must concern themselves with all those issues, whether the system lies within a booking tool or is integrated with one.

Contracting for a Booking Tool. Travel buyers have choices when contracting for corporate travel booking tools. They can deal directly with technology providers, often bundled with expense products, or go through agency partners reselling the tools. At first glance, it's cheaper to buy a booking tool directly. However, the tech provider may not provide the immediate support the travel manager or travelers need, and the TMC will charge a fee for stepping in. When buying a booking tool through a TMC relationship, the TMC typically bundles the tool with other services, provides support and maintenance, and charges a minimal fee per booking made through the online channel. Such package deals come with some restrictions, but most travel buyers are happy to accept them.

What Booking Tools Are Working On

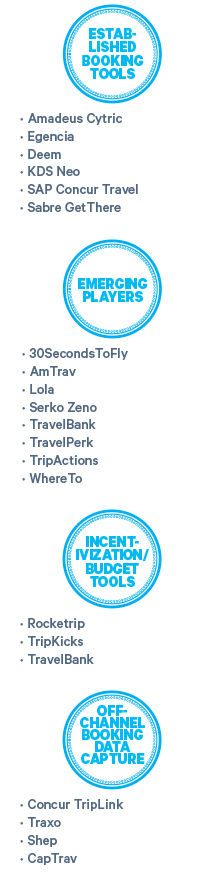

A shake-up is shaping up among booking providers. Established players are challenged by mobile-first providers whose machine learning and application programming interface-enabled content connectivity isn't retrofitted on legacy tech stacks but rather is part of their DNA. Established players, meanwhile, have the engines under their hoods to deal with large travel programs' complexities.

Traditional Market Leaders

Adopted more widely in Europe than in the U.S., Amadeus Cytric is investing in better search algorithms to display results that both comply with a company's travel policy and meet traveler preferences. The company will add an artificial intelligence-powered virtual assistant to its mobile app and to other messaging apps that integrate with calendars. The assistant will initiate a booking recommendation when an employee accepts a meeting invitation that indicates travel. The booking will include flight, hotel and transportation details; the assistant also will aid itinerary changes and/or rebooking.

Deem is upgrading its mobile app, optimizing airfare search capabilities, bringing in additional air content and expanding expense management integrations. The company will expand global content this year by integrating with the Amadeus global distribution system and hotel aggregator HRS. It also will partner with virtual payment provider Conferma. The tool's hotel shopping interface soon will include a mapping feature, and Deem will add advance scheduling for ridehailing.

Egencia recently added air and hotel booking features that leverage AI. It's adding features in areas like payment, customer service and predictive analytics to improve savings, policy compliance and the traveler experience.

Before American Express Global Business Travel acquired KDS in 2016, KDS Neo gained traction in Europe with its door-to-door booking concept. The brand has been quiet since then but plans to expand from 33 to 50 markets in 2019 while building out geographically specific content and functionality. The provider is fine-tuning its workflows, algorithms and interface to increase speed and simplicity. GBT also is using Neo's machine learning technology to power recommendations in other parts of its platform.

Sabre GetThere is focused on air content connectivity going into 2019. The booking tool will connect to Lufthansa's lowest fares via GetThere's Air Connect; as Lufthansa has pulled some of its value offerings off the global distribution system. GetThere also will make its workflow for travel budget and incentivization tool Rocketrip more seamless. And clients using Travelport's branded fares will be able to access those fares through GetThere.

SAP Concur Travel recently introduced a one-click air booking process, added Airbnb content and integrated with BCD Travel itinerary management tool TripSource and the CWT RoomIt sourcing tool. Concur added American Airlines, British Airways, Hertz, Hyatt and HRS to TripLink, and Delta and Singapore Airlines are coming soon. Concur now enables SeatFinder for users, in which travel agency automation tool Compleat monitors for better plane seats based on traveler preferences. In addition, the Concur app now enables messaging between companies and their travelers. It is expanding its air search from display of a single low fare to include a secondary low-fare offer. It also aims for easier comparisons between itineraries and plans to display the same air and hotel content on the desktop and mobile apps, with the same user interface and support for travel policy and rules. Concur also invested in an API that allows clients to share real-time search information with Concur App Center partners so they can provide travelers with services as they shop and book.

Smaller & Emerging Players

AmTrav, a travel management company dedicated to the small and midmarket buyer, has been a first mover in adding direct New Distribution Capability connections with its airline partners. The goal is to support negotiated corporate bundles, expanded ancillary options and enhanced servicing capabilities post-ticketing. The company continues to develop its integrated expense management solution so travelers can create expense reports without leaving the platform. In addition, AmTrav is adding more hotel inventory and expanding the number of airline upgrades it can process. In addition, AmTrav is adding more hotel inventory and expanding the number of its paid airline seat integrations, which allow travelers who don't have status with a carrier to book and pay for seat upgrades.

Booking and "mobile concierge" startup Lola continues to build relationships with airlines, hotels, car rental providers and others. The company is enhancing the speed and performance of its travel search. It will invest in more customizable profiles and options for travelers. The company also is working on itinerary sharing and trip collaboration, such as in-app recommendations from fellow employees.

New Zealand-based Serko Zeno entered the North American market last year. Targeted to small and midsize enterprises that have simple travel policies and prize fast onboarding, Zeno debuted NDC configurations last year, and Serko continues to enhance personalization and AI for its chatbot and for customized trip recommendations that incorporate policy and travelers' personal preferences. Serko also is working on chatbot-generated recommendations prompted by travelers' calendars.

In March, TravelBank introduced the Next Generation Storefront flight shopping experience based on ATPCO star ratings. The T&E platform added hotel content last year, as well as LodgingX for Airbnb, VRBO and HomeAway content. This year, it plans to provide its own discounts and special supplier rates and to expand its ground transportation offerings.

TravelPerk has gained traction in Spain, France, Germany and the U.K. and is expanding elsewhere. It has made attaching a TSA Precheck number to a booking easier and expanded train content.

TripActions was the first to introduce the Next Generation Storefront shopping display. The company is expanding to additional countries as its clients grow and is increasing the personalization of its booking options. The company aims to reduce to one minute the median time users spend booking a business travel itinerary.

Content Strategy

When buying a booking tool directly from the supplier, the travel manager determines the content that should be piped into the tool. That means the buyer chooses the GDS, connects directly to suppliers like Southwest and Lufthansa and brings in air content from aggregators like Travelfusion. The travel buyer also may pipe content in from lodging solutions providers like HRS, Booking.com or Airbnb that may not be available through their preferred TMCs. Some booking tool providers have relationships with content providers like Airbnb and Travelfusion and can turn their connections to these content sources on or off at the client's request. An organization with an ARC ID, typically a TMC, still is needed to complete air reservations made through corporate booking tools.

Planning and implementing an effective travel content strategy may fall beyond the expertise of most travel managers, particularly if travel management forms just a part of their jobs. As content becomes more fragmented, however, understand what is available via the contracted TMC and what is not—and how that compares with consumer channels, particularly for the corporate's most important air and hotel suppliers. TMCs have become more able and willing to aggregate sources and are offering more options to clients. As more airlines remove content from traditional distribution channels, these issues have become both more common and more challenging.

It's more difficult for a TMC, in the event of a change or a travel disruption, to manage and service a booking a traveler made directly with a supplier, as the TMC isn't associated with the booking from the supplier's point of view.

Configuring Policy

A booking tool's ability to specify corporate travel policy also may affect a corporate's decision to contract directly for the booking tool or work through a TMC. Typically, a booking tool comes with a policy administration panel. Configuration options may include travel vertical categories, specific suppliers, pricing, spend threshold, geography, time zone and employee type. The settings may be as simple as on/off buttons, or they may take the form of boxes to fill in codes, drop-down menus, places to upload documents like supplier contracts or even algorithms with adjustable weights for each factor.

Depending on how complex the policy is, some travel managers may find that configuring the booking tool requires a lot of time and effort, and those inexperienced with its processes and nuances may produce content displays that contradict policy. Further, the tool needs to be maintained and updated to make sure preferred suppliers and negotiated rates continue to be shown correctly and reflect policy changes. Some travel managers have this technical expertise; others employ third-party consultants that specialize in travel policy configuration. Even if a corporate buys the tool direct from the tech provider, it's fair game for the buyer to lean on the preferred TMC to configure the tool. As with a third-party consultant, this likely will come with a fee.

For clients buying booking tools through their TMCs, the agencies almost always have "master" booking tools with standard settings and will provide clones with settings tweaked for clients. TMCs have standard settings that display their own negotiated rates, as well as the suppliers that pay incentives and commissions back to the TMCs. TMCs also can suppress nonrefundable hotels and basic economy airfares, eliminate unknown car rental companies and block bookings outside regular business hours.

These "master" settings make sense for a lot of programs. For example, when a corporate doesn't have a negotiated rate on a certain air route or in a certain business market, it can rely on its TMC's negotiated rates. However, content that a travel manager doesn't want travelers to book may remain in the booking tool if settings aren't precise and, in some cases, that content may be promoted to traveler. Whether that content is prioritized in the booking tool purposefully or left as an artifact of imprecise configuration, it may not be in the corporate's best interest. It does, however, benefit the TMC, which receives compensation from those suppliers based on the number of bookings.

Best practice for a travel manager is to conduct an annual audit with the TMC and the booking tool provider. There, the three constituents should make sure the tool is configured correctly and continues to meet the travel program's unique requirements.

The Big Question: Compliance

Travelers book outside formal corporate channels for multiple reasons. Those attending conferences may book through the conference sites into designated room blocks. The traveler may get a better value, at a nonpreferred hotel, through status benefits. The hotels displayed in the corporate booking tool may not be close enough to the meeting location, or the traveler simply may dislike the corporate booking tool. The lost data gives travel managers an incomplete picture of their program and a significant duty of care challenge.

Booking tool providers are working to solve a number of those issues. Personalized recommendations and simplified, sexier user interfaces are part of that transformation. Policy integration complicates matters, but tech providers are pushing through that pain. Booking tool providers are hooking up more content pipes like Airbnb, HRS and airline direct connects to help travel managers bridge the gaps caused by content fragmentation. They also are working on better ways to display that content efficiently.

Incentivization Tools

A new category of tech providers is looking at the "loyalty gap" and mechanizing behavioral economics within the booking tool path. Rocketrip and Tripkicks are two. They are not booking tools per se but rather act as booking tool boosters by rewarding a traveler who books through the corporate tool when he or she beats an estimated trip budget. These technologies calculate and present these budgets to travelers as they initiate the bookings. Both integrate with established booking tools like Concur and GetThere and have relationships with TMCs. TravelBank, on the other hand, is a booking tool for small and midsize companies that has incorporated a budget-to-beat capability that's based on flight origin and destination, current hotel market rates, policy guidelines and number of nights.

For all three providers, the traveler's reward for beating the budget is a share in the savings that can be redeemed in, depending on the provider, gift cards, charitable donations or cash. There are tax implications for the recipient, and rewarding travelers for complying with requirements is controversial. There's also a question of whether it is equitable to provide incentives for traveling employees and not for those who do not travel. Even so, some corporates report positive compliance results.

Are Corporate Booking Tools a Full Solution?

Until corporate booking tools have full content and the right user experience to keep travelers in the booking tool, some travel programs need the ability to capture supplier direct bookings. Several technology providers supply nets beneath booking tools to capture corporate travel itineraries booked on consumer sites.

Concur introduced the most controversial solution in 2013. TripLink enables corporate negotiated rates on supplier websites and captures those bookings. Participating suppliers build their application programming interface connections into the TripLink network, and the supplier roster has not grown as quickly as expected. That impeded adoption by corporates, as did the idea of enabling travelers to book outside the corporate channel. Even so, Concur estimated in March that 8.5 million travelers have access to TripLink, whose suppliers now number 28, including air, hotel, car rental and other ground transportation providers.

Traxo, rather, parses booking confirmations, receipts and invoices into data that corporates can consume. Each traveler may send confirmations to a central email address for his or her company, or Traxo Filter can connect to a corporate email server and identify incoming travel details. The parsing capability also applies to hotel folio detail, which has proven difficult to manage even in expense reports. Concur TripLink also can parse itineraries forwarded by travelers, through TripIt. The extra step, though, creates a gap too wide for many programs to achieve full visibility. Another emerging player, CapTrav, works similarly to Traxo.

Then there's Shep, a browser extension that identifies when a traveler lands on a consumer travel website and then applies a very simple policy as the traveler books, keeping him or her within spend guidelines. Shep pushes that off-channel data back to the corporation.

Reporting from these suppliers provides visibility into where travelers are booking, as well as insight into whether those travelers booking outside the preferred tools are booking responsibly and whether their practices should drive changes. The travel program could tap new hotel partners or identify a market where the company needs to manage travel. There's an argument that for small companies, only tools like these are needed, but that certainly depends on company culture and total travel volume.

The Endgame: Booking Data & Reporting

At face value, the purpose of a corporate travel booking tool is to guide traveler choices through the booking process. In most cases, it guides the traveler through the preferred TMC. The policy configuration and mechanisms for alerts guide travelers toward preferred suppliers and toward cost optimization. Yet, it's the data captured through that process that provides the travel manager the power to control the travel program.

The travel manager wants to understand traveler booking behaviors like advanced purchases of airfares, the percent of itineraries that book hotel at the same time as air and whether travelers are buying within cost thresholds and with corporate preferred suppliers. If travelers do not comply with these guidelines, it may be time for the travel manager to figure out why. Are costs too restrictive? Has the program sufficiently sourced for the volume on certain routes or in particular markets? Do travelers have to go outside the program to access more conveniently located suppliers? On the other hand, travel volume data gleaned from the booking tool also empowers program managers when they sit down to negotiate with suppliers. If travel programs can prove their ability to hit volume targets or shift share to certain suppliers, travel managers can garner better deals for their companies. Those deals often form how travel managers' success is measured.

Yet the proliferation of off-channel booking tools underscores the deficiencies of booking tool data. On-channel booking data provides a narrow view of travel, in that it doesn't account for offline purchases like changes made at the airline kiosk or hotel front desk and it doesn't account for purchases made completely outside the tool. These issues are becoming more pronounced as airlines unbundle traditional ticket attributes and as booking tools struggle to keep up. Even purchasing discounted checked baggage or accessing some common seat classes like premium economy is impossible on most corporate travel booking tools today, including the market leaders. The reasons largely reside behind the corporate booking tools, in global travel distribution technology; thus corporate travelers must book on their companies' preferred booking tools and then go to the airlines' websites to take advantage of premium economy or to prepay for bags. Booking data just can't be considered complete.

AI-powered booking tools show potential to improve those deficiencies, and travel managers should keep an eye on how they transform the business travel experience. In the meantime, however, is it enough to control only the bookings that go through the managed channel? More corporates look to partners like Traxo and Shep to support a holistic view of the travel program. TMCs are getting onboard, as well. The more data travel managers have, whether from on-channel or off-channel sources, the better equipped they are to serve their travelers and their companies.

Serko North America SVP Tony D'Astolfo, Adelman chief information officer Ivan Imana, SAP Concur EVP of supplier and travel management company services Mike Koetting, Meritor global travel manager Jack Reynaert, InVision travel manager Jennie Robertson, BCD Travel VP of travel technology Saurin Shah, Acquis Consulting engagement manager Hansini Sharma and Christopherson Business Travel manager of online travel operations Sheila Thorp advised on this article.

___________________

Correction: A previous version of this article said FMC Travel had acquired 30SecondstoFly, which is not accurate. FCM Travel increased its investment in 30SecondstoFly. It does not own the company. BTN regrets the error.