As corporate travel comprises a major segment of expenses for many organizations, the links between T&E management are clear. But not all expenses are incurred by travel, and expense systems aren't always within the purview of corporate travel managers. Ideally, however, a travel manager will have at least some involvement in selecting and implementing a company's expense management tool, one of the most frequently used systems by many employees, especially those who spend significant time on the road, such as sales teams.

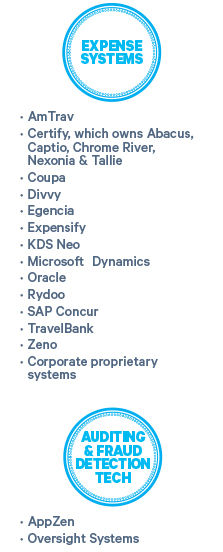

Dominated by SAP Concur, the expense management sector has over the past several years seen new challengers enter the fray, many of which emphasize tech-forward features like robust mobile functionality, optical character recognition and machine learning.

For decades, expense reporting was a tedious and cumbersome process, requiring employees to save receipts, tape them to sheets of paper, photocopy those and submit them physically. The next, "advanced"model relied on Excel spreadsheets but was essentially just as inefficient. But about a dozen years ago, a revolution enabled companies to remove paper and spreadsheets from the process. And while plenty still run old-fashioned expense reporting programs, many have recognized the benefits of digitizing and automating the process. Those benefits include happier employees and a more efficient approval process, freeing up managers to work on more directly profitable tasks.

Eliminating paper receipts and forms in favor of digital and automated processes offered another major advantage: data—and lots of it. Corporations now configure policies within their reporting tools, map employee expenses to specific units and cost codes, enforce policy-driven time frames for submitting reports and set up automated data feeds directly from corporate credit cards into the expense tools.

All that functionality comes at a lower cost than the paper-centric model. While figures vary, processing an automated expense report cost less than $7 on average, compared with more than $25 for a manual report. That's significant savings for a company of any size; for organizations processing thousands of reports annually, automation is a no-brainer.

Corporations shopping for expense tools should consider the level of automation they need. Those jumping on the bandwagon from "manual"Excel processes will get a big boost from simple automation. Others may be searching for more controls, more automation or more bells and whistles. Also consider what systems a given expense tool can hook into and how: general ledger, for sure, but also enterprise resource planning systems—remember that T&E is broader than just travel—booking tools, travel management companies, third-party vendors like Uber and Lyft and payment providers. Application programming interfaces are on the way to becoming the most common way for systems to communicate, though encrypted file transmission systems still are in play.

Once it's time to implement, back-office colleagues in tax; finance; payroll; accounting, including reps from all relevant world regions; legal; ERP; IT; and travel, as well as partners from the expense system, all should be in the room together to make sure the data feeds align as needed. Finance or the travel department may own the expense tool internally, but a project manager from the expense system supplier typically runs point, running through a list of questions so he or she can configure the system; unmanaged or lightly managed T&E programs likely are part of companies that don't have ERP systems, and setup for these more likely can be handled within the tool by someone at the client company. A few among the many questions a project manager for a more sophisticated expense tool will ask:

- Who handles the general ledger and ERP? Is it SAP, Oracle, proprietary? And how are they structured?

- What does the approval hierarchy look like? Employees' managers might approve expenses, a project manager might, or, for hands-off corporations, an expense tool's software might automate approvals.

- Who will reimburse employees once expenses are approved? Payroll or accounts payable could manage the payout internally, or the expense tool might disperse the money on behalf of the corporation, using bulk funds it receives from that company. Concur, for example, does this through Expense Pay using profile information provided by the employees in their Concur profiles.

Implementing an expense tool is a major task, and all the players need to agree on the system architecture before jumping in.

What Expense Management Systems Are Up To

In 2013, Certify launched ReportExecutive, which can automatically submits complete and compliant expenses according to a set schedule. In 2017, K1 Investment Management took a majority stake in Certify, merging it with ExpenseWatch, Nexonia and Tallie. The ExpenseWatch and Nexonia brands have merged. Also in 2017, Certify acquired NuTravel's online booking tool, and in 2018, it acquired Abacus and Captio, which operate under their own brands. Abacus is credited with starting the push to eliminate the expense report. In 2013, it began treating each charge as an individual transaction and filling in expense details using ocular character recognition on receipts, as well as geolocation and machine learning, to categorize expense and pair receipts with corporate card charges. Abacus also has experimented with a chatbot for entering expenses. In March 2019, Certify merged with Chrome River, gaining access to large and enterprise clients, as well as Chrome River's Prosper, which links up with Salesforce to help corporations determine ROI for business trips. (Another company, SalesTrip, similarly hooks up with Salesforce for travel ROI.)

This year, Coupa has enabled managers to set "spend tolerances"that amount to preapproval if employees stay within those bounds. That means automatic reimbursement without managers approving each report. The company also enables employees to manage their spend from Slack and allows managers to approve and reject expenses in Slack, as well. A year ago, Coupa completed its integration with AppZen for automatic expense auditing, and Coupa acquired fraud-detection company Deep Relevance in 2017. It also can import bookings from travel management company/booking tool TripActions.

In 2015, Expensify launched automatic expense submission and reimbursement capabilities like Certify's, though they work in real time rather than on a set schedule. In 2016, Expensify made its Realtime Expense Reports its default setting, though established companies tended to turn it off in favor of batched reports, CEO David Barrett said last year. Now, he says, "tens of thousands"of companies use real time reporting. Expensify has explored using chatbots for customer service. It also integrates with value-added tax reclamation companies Global VaTax and Taxback International. In April, the company integrated with Southeast Asia ridehailing company Grab to import transactions automatically. It has similar integrations with Uber and Lyft, as well as with the TripActions booking tool.

KDS Neo in April added machine learning power to its OCR receipt-scanning technology, which is now available on desktop, as well as mobile. It also has allowed users to save favorite driving itineraries to make mileage expenses easier to file.

After acquiring expense management tool Xpenditure and booking tool Maya in 2017, employee services firm Sodexo launched T&E solution Rydoo in 2018. Bookings flow into the expense tool, which also can populate line items from receipt images. Artificial intelligence and predictive analytics flag duplicate expenses and noncompliant expenses. It integrated to accept receipt feeds from Uber in October.

SAP Concur—which controls 50 percent of the expense management market, according to market intelligence firm IDC—has rolled out a bevy of tech tools of its own and is moving its thousands of corporate clients over to its "next generation"expense interface, with a mandatory migration deadline of 2020. The company said it designed the revamp to make the experience more intuitive for infrequent users and more efficient for frequent users. Concur's Slack-based chatbot, meanwhile, enables users to enter expenses by typing them in Slack messages—"expense $15 for Lyft"—and uploading the receipt images within the messaging system. Users can also request summaries of their expenses in Slack, while managers receive Slack notifications when they need to review and approve expenses.

Serko booking and expense tool Zeno has been building up its TMC partnerships of late: ATPI is the exclusive pilot partner in Europe, and both CWT and Direct Travel, which owns Vision Travel, resell the tool in the U.S. and Canada. Custom Travel Solutions and Voyages Encore Travel also resell it in Canada. Zeno also acquired U.S. expense management software Interpix in December and integrated with Uber earlier last year.

Any travel policy rules the stakeholders enter into the expense tool can't directly control traveler and employee behavior, as the expense system comes into play after transactions have happened and money has been spent. The expense system can require employees to input explanations for unusual or out-of-policy expenditures, or the system can delay or block reimbursement or notify approvers of unusual or out-of-policy expenditures.

Integrated Booking & Expense: Must-Have or Hype?

Since SAP Concur acquired booking specialist Outtask in 2006, observers have touted the advantages of providing an expense and booking tool under one roof. That integrated model enables bookings to flow directly into the expense system and offers clients a single relationship to negotiate and manage. Employees also gain a consistent user interface across both booking and expense, and travel managers gain the same for reporting; the latter is significant only if the travel manager also owns the corporation's expense program. A supplier that offers both a booking and an expense tool also has a prime cross-selling opportunity, as it can win corporate clients for expense through the corporate's finance department and subsequently leverage that foothold to add booking services.

For years after the Outtask buy, Concur was the only player that truly could offer both booking and expense, but others have followed suit. Certify acquired a booking tool from NuTravel in 2017 and has since added the service to its own-branded expense system and to its affiliated Abacus and Nexonia expense brands. Certify's recent merger with expense provider Chrome River represents yet another opportunity to apply booking capability to an existing expense management system.

Meanwhile, a new crop of travel management companies are combining booking and expense. Those include AmTrav, which added expense capability in late 2018, as well as TripActions, which is believed to be exploring the addition of expense functionality after quietly teaming up with payment and expense provider Divvy. Small and midsize enterprise-focused travel bookings specialist Lola also has tabbed launching its own expense management tool as a goal. Then there's KDS Neo. KDS launched its door-to-door booking tool in 2013 and revamped its expense solution in 2014. Two years later, American Express Global Business Travel acquired KDS, bringing the booking-and-expense stack under the umbrella of one of the industry's legacy service providers.

But while integrated expense and booking does have some clear potential benefits, dissenting voices have argued that those advantages have been overstated. According to those skeptics, Concur pushed the integration hype to justify its expenditure to acquire Outtask, and Concur's market dominance drove the narrative of integration as a "must-have."

Those observers have noted that, while it is indeed easier to deal with a single provider for expense and booking, it's more important to ensure that a corporate's specific needs are met in both expense and booking, even if it means tapping separate providers for each service.

Plenty of booking suppliers, such as Deem and Zeno, have opted to leave expense management to the expense experts, and they integrate with expense providers instead, something Concur does not do.

And while streamlined data flows are always a plus, booking tool integration on its own won't solve the problem of out-of-channel booking, a challenge better met by tools specifically designed to capture outside bookings, as well as by corporate card integrations that automatically populate spending on a linked card, no matter where it happens.

Mobile & Machine Learning Capabilities

The more recent mobile revolution has brought additional functions. OCR enables employees to upload receipt images so the system can populate an expense report's fields automatically. Integrations with third-party service providers like Uber and Lyft also stream travel expenses directly to expense tools.

As innovations in artificial intelligence, machine learning and OCR whittle down the human involvement required to create and approve an expense report, it's easier to envision a world in which expense line items not only are submitted but also are approved in a steady, automated flow, rather than batched by trip or by time period.

While many corporate expense managers remain cautious about ceding approval and reimbursement control to automation, several of the leading expense management providers have made significant strides toward the next generation of expense management. They leverage machine learning, meaning that the more receipts and data go through their systems, the more accurately the system can categorize future transactions based on what it has "learned." Meanwhile, rules engines embedded into those systems enable travel managers to set policy guidelines for spending, such as disallowing certain types of merchants, and to analyze expenses against that policy. Machine learning auditing technology like App-Zen and Oversight Systems also can identify expenses that are abnormal for the traveler, the job description or the kind of trip and can detect fraud.

The ability to set rules and to fine-tune rules-based systems leads to greater compliance in the long run, proponents of full automation have argued. Human approvers tend to approve reports quickly and thus to let policy violations slip through the cracks. Managers also may not review previous expenses that would help identify patterns of behavior. A computer can accomplish this in seconds.

Expense reporting capabilities have evolved from paper to Excel to automated software, making expense reports easier for both reporter and approver, the ultimate goal may be to eliminate expense reports altogether.

Edgewell Personal Care head of global travel, fleet and meetings Kelly Christner; GoldSpring Consulting senior consultant Jennifer Donnelly and partner Will Tate; AmTrav Corporate Travel president Craig Fichtelberg; SalesTrip VP of product Eoin Landers; Certify CEO Bob Neveu; and Chrome River CEO Alan Rich advised on this article.